Why Australia’s iron ore project is doomed

Economists and investors are very excited about the strength of iron ore. But this is why they need to be very careful.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

ANALYSIS

The headlines scream that iron ore is back.

The bears, those pessimistic about the market’s strength, are burned for getting the price wrong again.

But there are two reasons why this view of the iron ore market is wrong.

First, China is going through a major, and very likely structural, steel bust.

Just as bears predicted, it is based heavily on the failure of the Chinese real estate investment model.

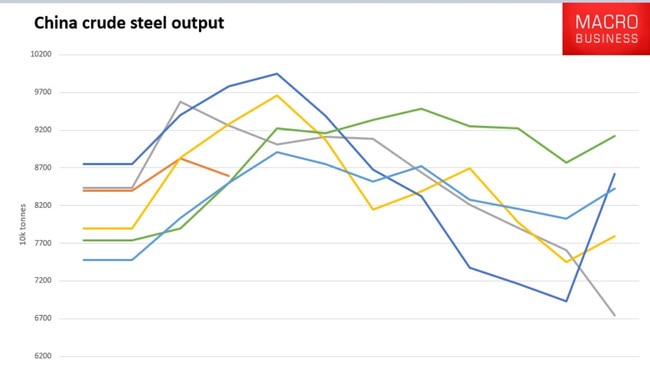

Chinese steel is expected to be down 2-3 per cent this year, an unprecedented drop for three straight years.

In April, the latest data, Chinese steel output was 12 per cent below the banner year of 2021.

This is roughly 130 metric tonnes of steel annualised, equalivent to 200 metric tonnes of iron ore; enough to wipe out Fortescue Metals Group.

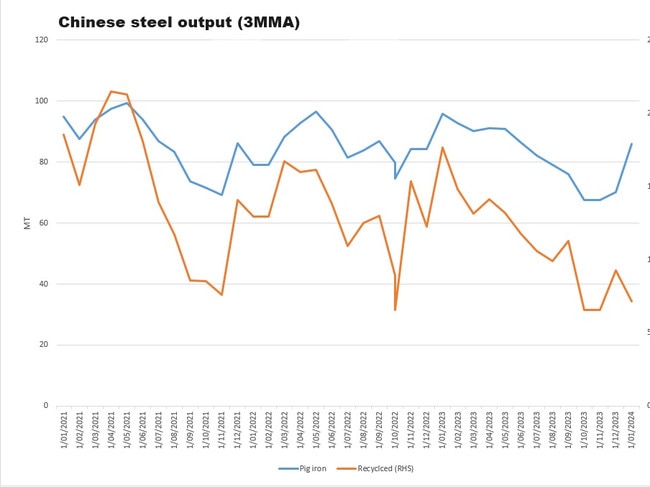

However, it hasn’t. Instead, what has been destroyed is Chinese steel recycling.

Whether by design or chance, China has betrayed its own Five Year Plan to lift recycled steel output and, instead, allowed it to crash.

Because recycled steel is made with electric arc furnaces from steel scrap, traditional blast furnace steel - or ‘pig iron’ made from iron ore and coking coal - has been let almost entirely off the hook.

However, this strategy has diminishing returns for China. At some point soon, Chinese steel will be forced to price its carbon output at home or abroad, and the pro-carbon steel gambit will fail.

The second factor that still favours iron ore bears is that high prices have been so generous that the supply-side response continues to build.

This month, Australia added the Onslow Hub, offering a not-inconsiderable 30mt of new supply.

Ahead is much more of the same from major producers. The ramp-up is especially strong in 2026/27 around the arrival of the Guinean Simandou mine, or ‘Pilbara killer’, as I labelled it some years ago.

This beast of a mine is expected to produce 120mt of the best iron ore in the world over the next few years.

Timed to coincide with the ongoing and permanent crash in Chinese demand emanating from its reversing demographic dividend.

Australia should avoid crowing over the relative strength of iron ore and instead focus on the looming price bust that has become more obvious than ever.

Originally published as Why Australia’s iron ore project is doomed