Why Australians are investing billions into NDIS services and providers

This is where the smart money is, according to Aussie billionaires and millionaires looking for their next payday. See who has invested in the NDIS.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Exclusive: From lingerie retail empires and chicken burger franchises to selling wheelchairs, mobility scooters and providing disability carers for those on the NDIS. This is where the smart money is, according to billionaires and millionaires looking for their next payday.

Private equity companies from Australia, the US and Europe are spending hundreds of millions of dollars buying up NDIS providers and services.

Many are currently operating at a loss as they are fattened up in preparation for sale.

But the $42 billion a year scheme which supports 650,000 Aussies can be very lucrative, with one public fund that also invests in the NDIS reporting more than 12 per cent in gains over the past 12 months.

The flood of cash into the NDIS has raised concerns among experts and workers that money supposed to pay for the care of some of Australia’s most vulnerable will instead end up in the pockets of already wealthy investors.

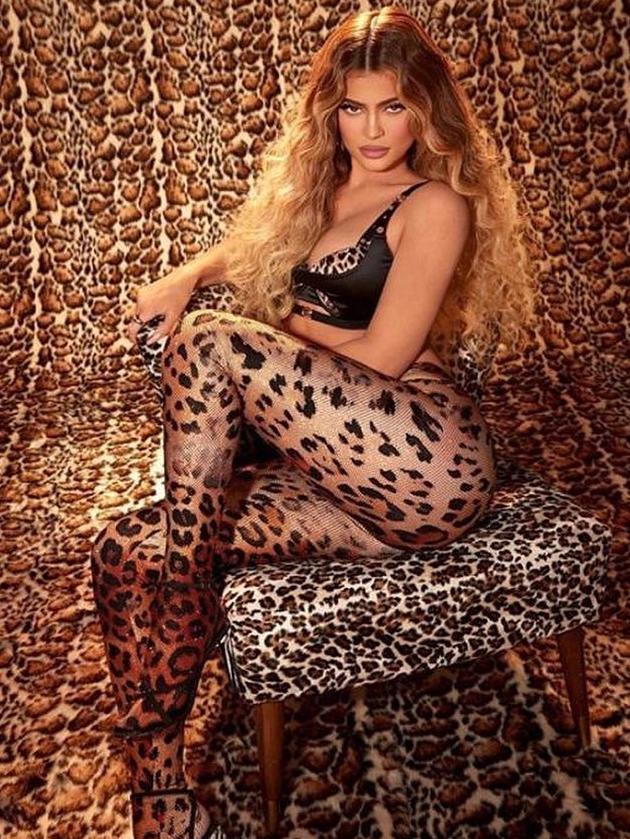

Among those chasing the NDIS boom is Brett Blundy, the billionaire Aussie retailer, who was behind multiple successful enterprises such as Sanity, a CD and DVD chain, and Bras N Things, which he sold for around $500m in 2018, lingerie group Honey Birdette and jeweller Lovisa.

He has lived in multiple countries including a four-level penthouse in Singapore’s Sengkang Square, with a rooftop infinity pool and a private gated home in the Bahamas, and now gives his address as a penthouse in a fashionable quarter of Monte Carlo in Monaco.

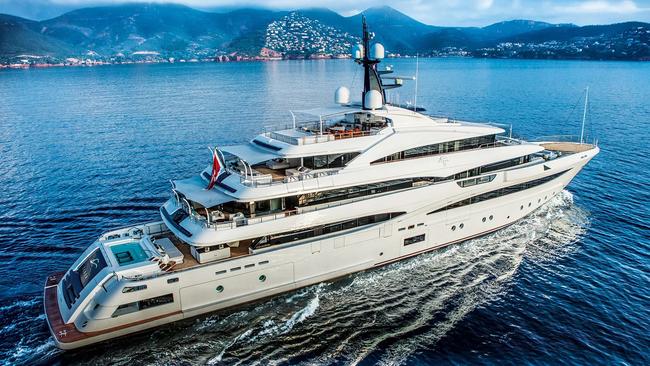

His 74m megayacht Cloud 9, which has been listed for sale, is worth an estimated $250m. It’s not known whether it has sold.

Mr Blundy is a shareholder in NDIS provider Independent Living Specialists, which sells disability aids including a $170 shower stool, alongside US private equity fund Riverside Company, which has more than $20bn in investments.

Fund documents show that other investors in ILS include Queensland state fund QIC and South Australian public sector super funds, as well as a host of rich Americans and other private equity groups.

Another wealthy investor in the sector is the multi-millionaire former chief executive of popular chicken burger franchise Oporto, Craig Tozer. He is now with Liverpool Partners, a Sydney-based private equity firm run by banker Jonathan Lim and former Seven Group executive Brad Lancken.

Liverpool and other private equity funds own health, aged care and disability service provider Zenitas.

Company documents show that other shareholders in Zenitas include two other private equity firms, Australia’s Adamantem and Swiss group Unigestion.

United Workers Union President Jo Schofield, said the NDIS should be solely serving the needs of participants, not the interests of billionaires looking for a pay-off.

“It’s also galling for workers that they are being stretched to their limits to provide support – understaffed, facing difficult environments – and yet some businesses seem to try to use the NDIS as an ATM,” Ms Schofield said.

She added that prices under the NDIS should be the same as main street pricing, and many of its concerns could be addressed by a mandatory registration scheme so that all providers are accountable and transparent.

Jason Ward, principal analyst at the Centre for International Corporate Tax Accountability and Research, said the NDIS was “not supposed to be a welfare program for wealthy investors but intended to provide much needed services to the community”.

“The extractive private equity model has left a trail of disaster around the world when it comes to public spending on social services,” Mr Ward said.

Associate Professor of Public Governance at the University of Melbourne, Helen Dickinson, said it was not surprising to see private equity investing in the NDIS because it was a privatised market by the government’s design.

“If private investors take the time to understand what’s important to people then who are we to say they are less entitled to turn a profit, like all organisations are allowed to do,” Assoc Prof Dickinson said.

Brett Blundy’s company BBRC and Liverpool Partners didn’t respond to requests for comment and Riverside Company declined to comment.

WEALTHY AUSSIES INVESTING IN NDIS

Brett Blundy

Investor in NDIS provider Independent Living Specialists alongside US private equity fund Riverside Company.

Estimated to be worth $2.42bn, Star Wars fan Blundy, who grew up near Melbourne, built his first fortune in music retailing through his Sanity chain, which closed its last bricks and mortar stores last year.

Other retail ventures he spearheaded include jewellery chain Lovisa and lingerie group Honey Birdette, which was sold to Playboy owner PLBY Group for $440m in 2021.

He bought superyacht Cloud 9 - which has all the usual luxury fixings including a jacuzzi and gym, as well as suites named after Star Wars characters - in 2017 and put it on the market with an asking price of about $250m, but it’s not clear whether or not it sold.

After a stint in Singapore he now gives his address as a luxury apartment block overlooking the main yacht port in Monaco where a three-bedder rents for about $180,000 a month.

Béla Szigethy and Stewart Kohl

The co-chief executives of private equity firm Riverside Company, which manages more than $20bn in investments.

Szigethy founded the firm in 1988 after a stint as a lender to management buyouts at Citibank and former university classmate Kohl followed him from the bank in 1993.

Szigethy lives in Manhattan while Kohl lives in Cleveland, where he is on the boards of several community organisations.

Craig Tozer

A former investment banker, Tozer became chief executive of chicken chain Oporto when it was owned by Australian private equity firm Archer Capital. In 2018 he and his identical twin David were close to buying stricken chocolatier Max Brenner, but the deal fell through. These days he’s a partner at Sydney private equity firm Liverpool Partners, which owns a stake in health care group Zenitas. He gives his address as a recently renovated four-bedroom house worth at least $2m, close by the water in Sydney’s Drummoyne.

Jonathan Lim and Brad Lancken

The managing partners of Liverpool Partners.

Sydneysider Lancken formerly worked for Archer Capital and was an executive at Kerry Stokes’s Seven Group Holdings.

He and his wife lived in a Point Piper pile they bought from Seven’s Bruce McWilliam until 2022, when they sold it for $15m.

They moved slightly inland from harbourside Point Piper to Bellevue, where they snapped up a $13.5m four-bedder.

Lim gives as his address a $9.2m villa near the beach at Bronte.