Westpac mortgage mistake sparks thousands of refunds

Refunds are flowing to Westpac customers after the bank discovered an error related to lenders – some from 10 years ago. Find out if you qualify.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

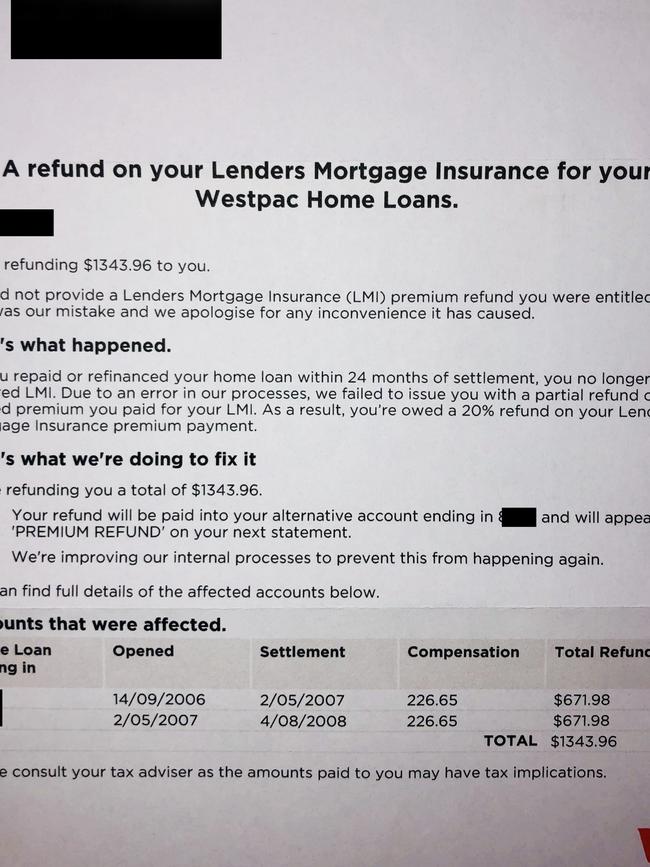

Exclusive: Westpac is sending refunds to customers after finding a “processing error” on thousands of mortgages – some from more than a decade ago.

Australia’s second-biggest mortgage lender failed to pay partial refunds of lenders mortgage insurance (LMI) premiums that customers were entitled to when they repaid or refinanced their home loans early.

The bank is not disclosing how many customers were affected or how much it is refunding, but it’s understood more than 4000 customers have already got money back.

Refunds seen by News Corp Australia are for home loans that were paid out before 2010.

Westpac managing director mortgages Anthony Hughes said the bank was “well progressed in refunding customers”.

“Westpac continually reviews its products and services,” Mr Hughes said.

“As part of this, we identified a manual processing error which led to customers not receiving a partial reimbursement for their lenders mortgage insurance premium when they paid out their loan, in full, in under 24 months.”

Lenders mortgage insurance is usually charged by lenders when a borrower does not have a 20 per cent deposit for a home.

The cost varies depending on the size of the loan and deposit, but for an average mortgage can cost more than $10,000.

“We have updated our operational processes to prevent this from happening again,” Mr Hughes said.

“We apologise to the customers impacted and want to assure them no one will be left out of pocket for this error.”

Westpac refunds 40 per cent of LMI premiums if the mortgage is discharged within 12 months and 20 per cent if it’s discharged within 12-24 months.

Financial services research group Canstar said many lenders did not refund LMI premiums, and it would be a welcome surprise for Westpac customers after so many years.

“There aren’t too many industries I know where if you have been overcharged 13 years ago they will come out and say that,” said Canstar’s group executive of financial services, Steven Mickenbecker.

Mortgage broker Financia’s managing director Angelo Benedetti said average LMI premiums for his clients were $6000-$7000 but some cost tens of thousands of dollars.

He said LMI was becoming increasingly common as rising property prices pushed up required deposits to $50,000-$100,000 for many borrowers.

“The only way to avoid it is with a larger deposit or have mum and dad as guarantor,” Mr Benedetti said.

He said if anybody had paid out or refinanced a loan that had LMI attached it was “definitely worth asking” if a refund was available.