Twitter fury erupts over ‘arrogant, snide’ bank boss

Twitter has erupted in fury about multi-millionaire “revered” NAB chairman Ken Henry’s “arrogant, scoffing” performance at the banking royal commission.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Twitter has erupted in a fury over the “arrogant, petulant, disdainful” performance of National Australia Bank chairman Ken Henry at the banking royal commission.

Dr Henry, a multi-millionaire who was once Australia’s most powerful and revered public servant, has sparked the outrage by grunting responses, scoffing at questions or refusing to answer, and talking under his breath.

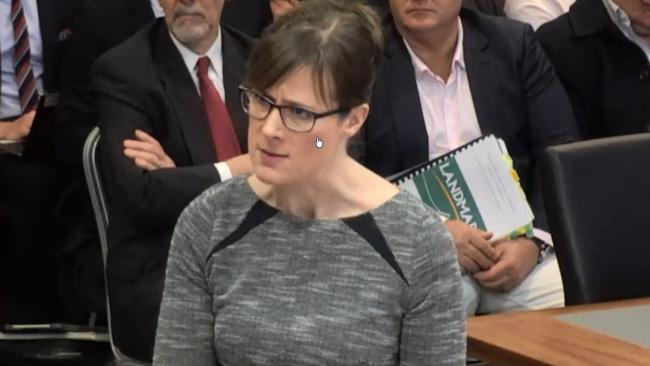

The former Treasury Secretary told senior counsel assisting, Rowena Orr, QC, the questions he thought he needed to answer, and those he didn’t.

Posters on Twitter believed his “snide” and “flippant” responses should lead to his stepping down from the NAB board and one called him a “dinosaur”.

Ken Henry! Arrogant Idiot, in his mind ripping customers off appears to be the customer’s problem. Any self respecting shareholder should demand his immediate resignation.

— Peter O'Connor (@gretep4) November 27, 2018

Whoever edited Ken Henry's Wikipedia page to reflect his performance yesterday at the #bankingrc got it 100% right. #auspol #Banks pic.twitter.com/H9wriMhUNF

— Jay P Hell (@JayPHell1) November 28, 2018

Others said Henry had “bullied … disrespected” Ms Orr and some threatened to close their NAB bank accounts immediately.

Dr Henry’s Wikipedia page was briefly re-edited to say that he had come across at the Royal Commission as an “arrogant tool and a genuine ballbag”.

While other banking and financial institution chiefs have offered the royal commission apologies and conceded mistakes, Dr Henry was less willing.

Take this exchange when Ms Orr grilled Dr Henry about the NAB board’s response to the “fees for no service” scandal.

NAB executives reportedly kept quiet for 11 months before informing the regulator ASIC the bank was $34.6 million in breach of slugging customers.

Question for @AndrewThorburn, is Ken Henry's indifferent and flippant attitude a real window into the culture at @NAB? My wife still has transaction accounts with NAB (after I pulled my super from MLC), she is now adamant they are closing this week #bankingRC

— Jezalenko (@jezalenko) November 28, 2018

Ken Henry has to go! His attitude towards customers is disgusting !

— Michael Lee (@Michael_lee888) November 28, 2018

Orr: Do you accept that the board should have stepped in earlier?

Henry: (long pause) … I wish we had, let me put it that way … I still don’t know …

Orr: I’d like you to answer my question Dr Henry. Do you accept that the board should have stepped in earlier?

Henry: I’ve answered the question how I could answer the question.

Orr: I’m sorry, is it a yes or a no Dr Henry?

Henry: I’ve answered the question the way I choose to answer the question.

Orr: Well I’d like you to answer my question. Do you accept that the board should have stepped in earlier?

Henry: I wish we had.

Orr: I’m going to take that as a yes, Dr Henry

Henry: Well you take it as a yes. alright?

Twitter posters also took exception to Henry’s honorific of “doctor”, @thehonestbank tweeting, “Just because you have a DR in front of your name does not mean you are GOD. “Unfortunately NAB’s Ken Henry did not get the memo.”

Dr Henry says "The Capitalist system only has consideration for Shareholders." Ie no obligation to worry about the destruction of lives of pesky customers. BANKERS had ASIC on a long leash, no bark no bite. CORRUPTED BANKING SYSTEM as we have been pointing out for 18 yrs.

— Denise Brailey (@DeniseBrailey) November 27, 2018

Just because you have a DR in front of your name does not mean you are GOD. Unfortunately NAB's Ken Henry did not get the memo. #BankingRC https://t.co/f1T661AyX7

— honestbank (@thehonestbank) November 27, 2018

Dr Henry AC, a doctor by way of a PhD in economics and a Companion of the Order of Australia for his work as an economist and preserving the habitat of the endangered Hairy-nosed wombat, at one point dismissed Ms Orr’s questioning..

“We’ve been through” the issue, he told Ms Orr, to which we replied: “No, I’m sorry I don’t think we have.”

Henry shot back, “You don’t?”

Orr: No.

Henry: (under his breath) No, you wouldn’t.

Ms Orr queried Henry about NAB’s lack of formal record about breaking the law when it made a formal breach notification for charging at least 12,000 customers $2 million in fees for no service.

Orr: Surely someone within your business at that point was thinking about whether this conduct contravened the law, and, if so, how it contravened the law?

Henry: Yes.

Orr: Surely those were matters that the chief risk officer should have reported to the risk committee?

Henry: “Perhaps.”

Orr: Back to where we started, ‘perhaps’, Dr Henry?

Henry: Yes, perhaps.

Orr: And I’m afraid I still don’t understand the reason for your hesitation?

Henry: I probably can’t explain it to you.

class="twitter-tweet" data-lang="en">

With an attitude like this, Ken Henry shouldn’t be running a bake sale, much less a Big 4 bank. Dinosaurs in the Australian business community like Henry need to ship out.

— Will Jones (@WJ23A) November 28, 2018

At other times, Dr Henry appeared to ignore Ms Orr's questioning. When asked about bank executives huge bonus payouts, he began talking about the state of capitalism.

“The capitalist model is that businesses have no responsibility other than to maximise profits for shareholders,” he said. “A lot of people who have participated in this debate over the past 12 months have said that’s all that you should hold boards accountable for, is that they are focused on the maximisation of profits for shareholders.”

Asked by Ms Orr whether he’d previously seen a document she had shown him, Henry said he couldn’t remember.

“It doesn’t matter really, does it?” he said, before looking up at Ms Orr’s stony response and adding, “Maybe it does.”

Ken Henry should resign immediately

— Josh Bornstein (@JoshBBornstein) November 27, 2018

Dr Henry has worked as a tax consultant for both Liberal and Labor governments.

After working for former prime minister Paul Keating to successfully defeat opposition leader John Hewson’s Fightback! GST 1993 election campaign, Henry did work for John Howard.

He went on to work for Kevin Rudd, writing the 2010 Henry Tax Review and for then prime minister Julia Gillard as a special adviser.

Fairfax press was damning of his royal commission performance with the Australia Financial Review describing it as “tone deaf”.

“Henry worked to portray himself as a deep thinker … but in doing so he muddied the waters around NAB’s attitudes towards key issues of governance and customer care” the AFR wrote.

Appointed in 2011 to the NAB as executive director and then in 2015 as chairman, Dr Henry has also been a director of the Reserve Bank of Australia.

In 2016, Dr Henry stated a belief that the gulf between the hefty pay packets of chief executives and the little average workers were paid could not be wider.

He said he would work on aligning pay towards customer outcomes.

However, last year on the same day the NAB reported a $6.64 billion profit, it announced it cut up to 4000 bank jobs.

And despite Dr Henry’s aim to reduce executives obscenely large salaries, NAB chief executive Andrew Thorburn may achieve a record earn of $10.76m this year if he achieves performance targets.

As chairman, Dr Henry, who comes from a humble background, having grown up in Taree as the son of a timber cutter, himself earns $790,000 from the NAB.

He also gets paid as executive chair of Institute of Public Policy at the Australian National University and Chair of the Advisory Council of the SMART Infrastructure Facility at Wollongong University.

Dr Henry has said his rural origins have made him a passionate conservation campaigner, with he and wife Naomi on the council of the animal protection institute, Voiceless.

“There are few pursuits more noble in life than giving voice to those who would otherwise suffer in silence,” Dr Henry says on his Voiceless profile.

But he is talking about his beloved Hairy-nosed wombat, not banking customers.

Originally published as Twitter fury erupts over ‘arrogant, snide’ bank boss