The words haunting politicians after banking royal commission uncovers staggering misconduct

The PM has been forced to eat his words after fighting to stop the banking royal commission — and he’s not the only one.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Now that the banking royal commission has uncovered staggering misconduct in the industry, everyone’s apologising and trying to organise photo ops to claim credit for the outcome.

But it took years for the commission to be called and many politicians resisted growing pressure for the inquiry, describing it as “rank socialism” and a “populist whinge”.

Nationals senator John “Wacka” Williams led the calls for a banking royal commission from 2009, before the Greens and then Labor adopted the policy.

A Senate inquiry first pointed to the need for a royal commission in 2014 but the Coalition resisted calls for an inquiry.

Stories kept emerging about the banking sector including allegations of interest rate trading and a Four Corners investigation into unscrupulous tactics in the life insurance industry.

Labor first promised to call a royal commission in 2016 but Prime Minister Scott Morrison, who was treasurer at the time, dismissed Labor’s announcement as a political move in a federal election year.

“For Bill Shorten to go down this path, I think it is a reckless distraction that puts at risk confidence in the banking system,” Mr Morrison said.

He later told Mr Shorten to stop playing “reckless political games” and described the push as a “populist whinge”.

Mr Morrison warned about the consequences of a royal commission saying concerns had already being raised at an International Monetary Fund meeting about whether Australia’s banks were in trouble.

At the time, 65 per cent of voters supported a royal commission, according to a Fairfax/Ipsos poll. The Greens and even some Coalition politicians also supported it including Nationals MP John Williams and Queensland LNP MP Warren Entsch.

Then-prime minister Malcolm Turnbull acknowledged “bankers have not always treated their customers as they should” but resisted calls for a commission saying it could hurt confidence in the system and Australia’s reputation internationally.

Labor lost the election but the calls continued for a royal commission.

In response, then-financial services minister Kelly O’Dwyer said in an opinion piece published in the Sydney Morning Herald that Labor’s support for an inquiry was “reckless and ill-conceived”.

“Critically, a royal commission would go over old ground and would delay well-developed and important reforms, such as lifting the professional standards for advisers,” she wrote.

“The work the government is already undertaking will provide ongoing scrutiny, greater resourcing and a stronger regulator, instead of a one-off, time-consuming and expensive royal commission that will not benefit consumers or the Australian economy.”

But a growing number of coalition MPs started threatening to cross the floor on the issue including Queensland LNP MP George Christensen and Nationals senator Barry O’Sullivan.

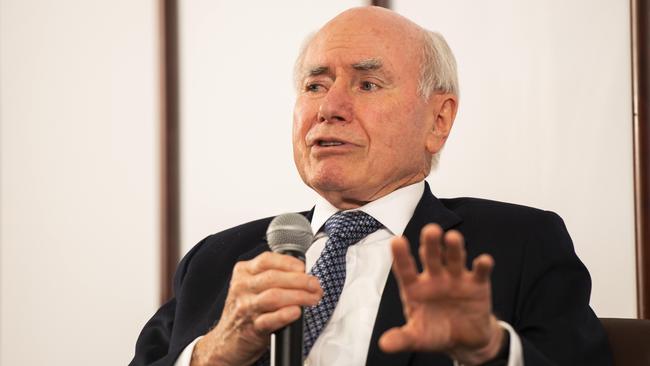

Eventually former prime minister John Howard emerged to slam the idea, describing it as “rank socialism” and suggesting the mutiny was due to anger about the same-sex marriage vote.

“I say to my former colleagues and the people I still support, don’t embrace a royal commission, and to those in the National Party and elsewhere who might see this as some kind of retaliation for co-operation between people on the same-sex marriage issue, I would say that I agreed with those people in the National Party on the substance of the same-sex marriage issue, but that is over,” Mr Howard told David Speers’ Sky News program.

“Let’s not visit upon the Coalition and the fortunes of the government your anger and disappointment about that issue.”

However, even the emergence of the elder statesman was not enough to quieten the increasing number of voices calling for the inquiry.

‘POLITICAL UNCERTAINTY MUST END’

These voices became difficult to silence when MPs Barnaby Joyce and John Alexander were identified as dual citizens and had to leave the parliament to contest by-elections in their seats.

Mr Turnbull’s control of parliament was on shaky ground but the final blow was likely dealt in November 2017 when a letter signed by the chairpersons of the Commonwealth, Westpac, NAB and ANZ banks also called for an inquiry to restore confidence in the system.

“It is now in the national interest for the political uncertainty to end,” they wrote.

“It is hurting confidence in our financial services system, including in offshore markets, and has diminished trust and respect for our sector and people.”

Given the government’s reluctance to back the commission, with Labor suggesting Mr Morrison has voted against the inquiry 26 times, it’s understandable Commissioner Kenneth Hayne declined to shake Treasurer Josh Frydenberg’s hand during an awkward photo op last week to mark the report’s handover.

Mr Turnbull has now admitted the decision to hold an inquiry should have been made earlier.

“I believe, with the benefit of hindsight, that we should have held the royal commission earlier,” he said.

“You can make a very good case for saying it was started perhaps a year later than it should have been, or 18 months later than it should have been.”

The former prime minister said he and Mr Morrison were working on a compensation scheme for the banks’ customers at the time, and felt a royal commission would delay it.

“We were well advanced with a compensation scheme to deal with the victims of various bank malpractices, I suppose, is the best way to describe it. And that was put on hold when the royal commission was set up.”

Ms O’Dwyer also apologised last year for not calling the inquiry earlier and said the government got the timing wrong.

Last year Prime Minister Scott Morrison admitted he was wrong not to address the “real hurt” Australians were feeling at the hands of the financial sector.

But Treasurer Josh Frydenberg said on Tuesday it was time to move forward.

“I think everybody has been surprised by some of the things that they’ve heard through the royal commission, but the important thing is to look forward to the future,” he told Seven’s Sunrise.

He has promised action on all 76 recommendations in the royal commission’s final report but is avoiding a crackdown on mortgage brokers that could end 25,000 small businesses.

Regulators, who copped criticism for being far too weak on financial institutions, will be given more resources and stronger powers.

The two key regulators — the Australian Securities and Investments Commission and the Australian Prudential Regulation Authority — say they are already reviewing enforcement tactics.

“I think you’ll see a much more forward-leaning approach on all these issues,” Mr Frydenberg said.

SHARE PRICES BOUNCE BACK

The final report of the commission was released this week and it delivered a scathing review of the sector after revealing misconduct including fees for no service and predatory lending practices.

It has already claimed the scalps of AMP’s CEO Craig Meller and chair Catherine Brenner, led to a share price slump and sparked class actions.

There’s speculation the jobs of National Australia Bank’s chair Ken Henry and CEO Andrew Thorburn are also at risk.

But share prices for the major banks soared on Tuesday as investors expressed relief that the report's recommendations shied away from harsh measures which could threaten profits.

The year-long investigation referred more than 20 cases to regulators for possible prosecution, but crucially for markets, stopped short of recommending a shake-up of bank structures.

At midday trade in Sydney on Tuesday, shares in the “big four” banks were tracking higher, with the nation’s biggest financial house Commonwealth Bank up by 4.59 per cent to $73.52, ANZ by 6.34 per cent and Westpac by 6.55 per cent.

Even stocks in NAB, whose chairman and chief executive were singled out by the inquiry’s commissioner Kenneth Hayne, jumped by 4.70 per cent.

“The much anticipated release of the Royal Commission Final Report was disappointing, in our view,” UBS analyst Jonathan Mott said in a note to clients.

“The final recommendations fell well short of market expectations … without powerful recommendations, we are concerned that ensuring lasting cultural change over the years may be difficult, especially as management and Boards rotate.”

on Tuesday, Deutsche Bank analysts said the 76 recommendations, which included closing legal loopholes and increasing protections for consumers such as banning some aggressive sales practices, were practical but possibly “too docile”.

Global ratings agency Moody’s added that the report’s lack of calls for a wide shake-up of banking structures was a “positive for bank profitability”.

Mortgage brokers and other non-bank financial institutions, which face stricter regulations and the removal of commissions if the recommendations are adopted, were the big losers, with share prices in listed firms tumbling on Tuesday.

Mortgage Choice shares plummeted more than 30 per cent after the broker warned recommendations would hand even more power to the big banks, making it harder to access credit and driving up interest rates.

— With AAP

Continue the conversation @charischang2 | charis.chang@news.com.au

Originally published as The words haunting politicians after banking royal commission uncovers staggering misconduct