The Rose Hotel and Kurrajong Hotel placed in external administration

A pub that was established more than 100 years ago and another well-known haunt are facing a crisis.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Two popular Sydney pubs, which are part of a major pub empire, are facing trouble after they were placed into external administration.

Companies associated with The Rose Hotel on Oxford St in the Sydney suburb of Paddington, and Kurrajong Hotel in Erskineville have had insolvency firm Ankura appointed as external administrator, according to ASIC documents.

The Rose Hotel had stood empty for years before being resurrected in 2022 and was originally opened over a hundred years ago before being knocked down and rebuilt in 1939.

The pubs are part of the Public Hospitality Group, which owns 22 pubs across Sydney and Melbourne.

Other pubs in the group include Vine Hall in Collingwood and the Town Hall in Balmain.

Public Hospitality Group had previously been pushing for an ASX-listing a few years ago but in recent times have faced financial hardship with the pub group amassing loans worth $400 million and falling behind on its debts, according to The Australian.

Ankura senior managing partner Quentin Olde is in charge of the administration but said there was no comment when approached by news.com.au.

It comes at a torrid time for the pub and hospitality industry which is facing increasing expenses while the cost of living crunch has slashed customer’s disposable income.

A string of well known outfits have gone under this year including 135-year-old pub The Carringbush Hotel that was forced to close its doors permanently.

Popular Sydney outfit Malt Shovel Brewery will also be shuttered at the end of August, impacting nine staff members with its owners blaming costs like energy, labour and ingredients, as well as government excise, which is now the third-highest in the world.

A number of other independent breweries have gone into administration in the past year including Brisbane-based Ballistic Beer Company, Adelaide business Big Shed Brewing, Melbourne-based Hawkers Brewery and the Wayward brand and Akasha Brewery, both from Sydney.

Insolvencies for Australian businesses are now at a record high as the impacts of stubbornly high inflation, interest rate increases and declining consumer demand squeeze margins, according to new data from CreditorWatch.

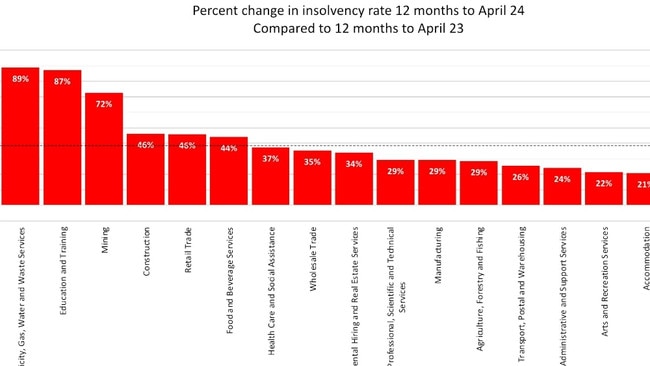

It showed an average increase in the rate of insolvencies of 38 per cent over the year to May 2024 across all industries.

ASIC figures also revealed there were 1245 insolvency appointments in May, a jump of 44 per cent on the 866 appointments made a year ago, soaring 122 per cent more than 2022. This is the highest number of insolvency’s since ASIC began its record keeping in 1999.

The total number of insolvencies is up 34 per cent year-on-year and 41 per cent above its pre-Covid maximum with food and beverage services most at risk, according to CreditorWatch.

The increasing impact of cost-of-living pressures on consumers is hitting businesses hard, said CreditorWatch CEO Patrick Coghlan.

“Multiple interest rate hikes and stubbornly high inflation have forced consumers at all income levels to cut back on spending,” he said.

“We don’t expect a meaningful turnaround in consumer confidence until the impact of at least two rate cuts has been felt, which won’t be until well into 2025.

“The only bright-spot for households is next-month’s tax cuts, although we don’t see much of this going to discretionary spending.”

He added the remainder of 2024 will be extremely challenging for businesses, as interest rates are unlikely to fall before the end of the year, and money flowing through the economy is focused on non-discretionary goods and services.

More Coverage

Originally published as The Rose Hotel and Kurrajong Hotel placed in external administration