Snowdon Developments collapses leaving 550 homes in limbo, $18m owed

An email sent out to hundreds of people late on Friday confirmed their worst fears. Now up to 550 homes are in danger with $18 million on the line.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

A residential building company that collapsed last weekhas left 550 homes in limbo and 262 creditors are cumulatively owed $17.8 million.

On Friday news.com.au revealed that Victorian construction firm Snowdon Developments Pty Ltd had gone into voluntary administration.

All 52 staff were terminated in an hour-long crisis meeting that day where the company’s directors announced they had appointed external administrators.

It came after months of building works stalling, suppliers and subcontractors chasing payments and employees not receiving their superannuation. Staff also claimed they had not received their fortnightly pay due on Monday.

News.com.au has spoken to one of the joint administrators, Shane Deane of Dye & Co, Solvency, who said: “When they [companies] stop paying super and when they stop paying the ATO, that’s usually a fairly strong sign that they’re trading while insolvent or [there is] significant cash flow issues.”

Snowdon Developments has allegedly not been paying staff superannuation since October, news.com.au understands.

It comes as the building industry is in crisis as fixed price contracts and rising material costs have left many business no choice but to collapse, with two other construction firms going under earlier on Monday.

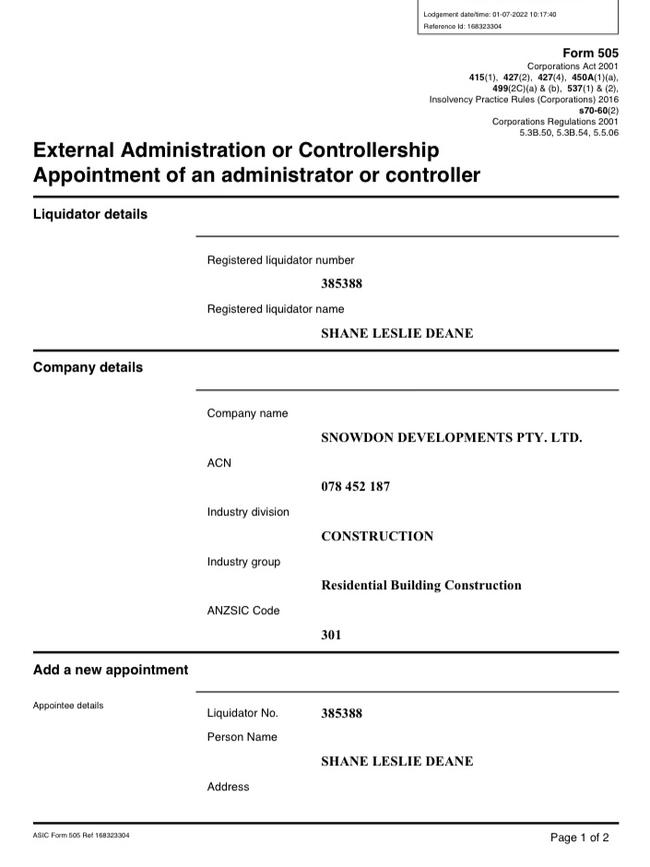

Snowdon Developments entered a creditor’s voluntary administration on July 1.

Shane Deane and Nicholas Giasoumi of Dye & Co, Solvency and Turnaround, were appointed as administrators.

“The control of the company has reverted to administrators,” they informed creditors in a document emailed late on Friday.

“The company has ceased to trade with immediate effect,” they added later on in the email.

Mr Deane said “at last count” Snowdon’s debt had snowballed to $17.8 million between its 262 creditors. Of that, the largest debt is around $4 million, to the tax office. There are also three private creditors owed more than $1 million each.

There are also 252 customers who “paid their deposit and nothing happened” according to Mr Deane, saying they were in very preliminary stages of their building works.

A further 268 home buyers are in “various stages of completion”.

On top of that, Snowdon has $9 million it owes to “related creditors” which Mr Deane explained was “director-related entities putting money into Snowdon to keep it afloat”.

Snowdon’s sister company Pivot Construction Group Pty Ltd, which was a developer with the same office, staff and leadership team, is also involved in the administration proceedings.

It has 74 homes impacted and also 136 creditors — many of them also creditors of Snowdon’s — owed a total of $4.5 million, with the highest single debt being $600,000.

“The business was suffering from cashflow and supply issues as a result of the Covid pandemic which has significantly impacted the construction sector,” the administrators wrote in their preliminary report shared with creditors.

Despite first talking to administrators in April, the company continued functioning until July.

“The intention was to trade the company out of its difficulties,” the administrators report stated.

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

Snowdon has held multiple meetings with government departments hoping for an eight-figure payout to keep creditors happy.

They “estimated that between $15 to $20 million was required as a loan to finance the company” administrators noted.

On June 28, Snowdon representatives approached the Victorian Managed Insurance Authority (VMIA) for financial support.

Although the VMIA “listened” they “had no financial options available”. Snowdon was referred onto the Department of Treasury and local government.

Two days later, on June 30, Snowdon’s directors met with the Department of Treasury.

“The initial response from Treasury was not favourable,” the administrators said.

The next day, they went into administration.

“If it [external funding] was going to be happen it would probably have been done by now,” Mr Deane said.

According to the administrators, Snowdon’s director Chris Sandner first approached them back in late April, a few weeks after a creditor started legal action.

Casabene Plumbing began winding up proceedings against Snowdon and 14 other creditors also joined the case, with the debt blowing out to $2.5 million.

They applied for a winding up order in the Supreme Court of Victoria to force the company to go into liquidation “on the grounds of insolvency”.

Snowdon Developments paid back some of the debt and assured creditors that the rest could be paid after a property was settled on Monday, July 4.

However, administrators revealed the building company was “particularly concerned that a large creditor would support the application to wind up and that the company would be unable to fund it from its own funds”.

The Supreme Court hearing will still decide the fate of the company, as there’s a very real possibility it could go into liquidation.

“We note that there is currently an application to wind up the company which is due to be heard on 13 July 2022,” administrators said.

“Should the court order that the company be wound up (liquidated) on that day the voluntary administration will end, and a liquidation will commence.”

A virtual meeting of creditors is being held next week, two days before the liquidation hearing on July 13.

Mr Deane fully expects the company to be liquidated. The only way out is if the government bailout pulls through or if another building company buys Snowdon Developments — which he said was extremely unlikely given the current market conditions.

Michael Hassan’s company MD Demolitions was one of the 15 creditors taking Snowdon to the Supreme Court after waiting for more than six months for $103,000 owed to be paid back.

Mr Hassan, with three young kids to support as well as 30 staff who work for him, has visited Snowdon’s Keilor Park office six times trying to get his money.

“There was no money coming into the account to feed the family or pay off the workers,” he previously told news.com.au.

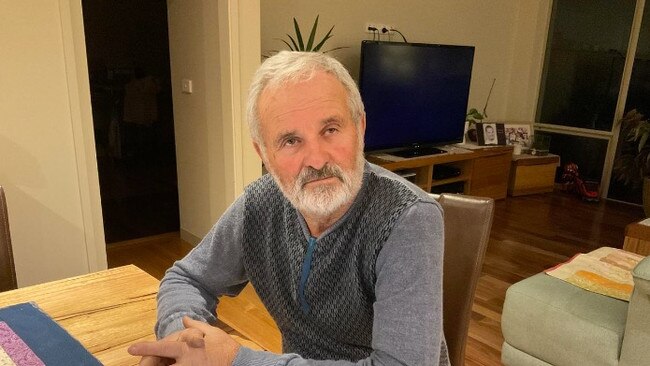

Nick Mihajlovic, 67, contracted for Snowdon through his bricklaying business for 22 years and claims he is owed $480,000 from work done all the way back in 2019.

“I’m financially ruined,” he said. “I’m 67 years of age and I’ve got to keep working.

“I came back to brick laying, I’ve got to make money, all my debts to pay.”

The biggest debt revealed through the court proceeding was $936,192 for a roofing company called East West Roofing.

Several suppliers who spoke to news.com.au said they suspected Snowdon had experienced financial difficulties since 2019, as they always struggled to pay their bills on time.

A staff member, Logan, who lost his job after the company-wide meeting last Friday, said there was “an extensive list” of trades who were refusing to work for Snowdon because of outstanding bills. The list had around 50 different suppliers and contractors on it, he said.

News.com.au is aware of more than two dozen customers who built with Snowdon who have been left in limbo for months.

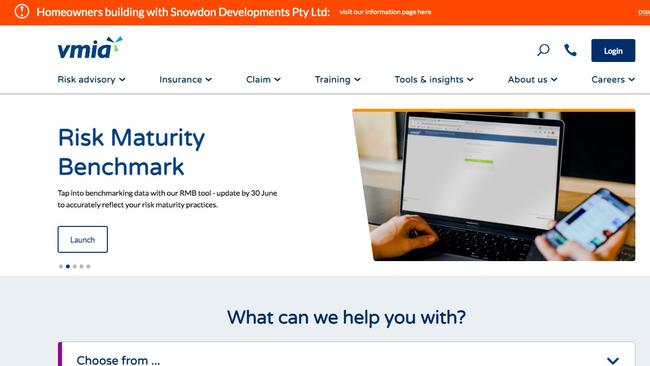

Mr Deane has advised them to go the VMIA website to lodge a claim.

“Obviously this is impacting homeowners,” the administrator said. “For most of us your home is the biggest spend you’re going to have on your life. Obviously we’re working for creditors but we also want to help homeowners.

“Some of them won’t be insured but we’re currently working through that, hopefully it will minimise the effect that this administration is having on them.”

The VMIA has been so overwhelmed from queries from Snowdon customers about the possibility of getting some of their money back through insurance that they have placed an alert on their homepage.

On their website, they wrote: “The appointment of the administrator means the DBI [Domestic Building Insurance] policies have been triggered, potentially entitling homeowners to make a claim.”

Unfortunately, domestic building insurance is limited to covering a maximum of 20 per cent of the building contract price, meaning many homeowners are out of pocket.

Melbourne high school teacher Rebecca Cook is in a difficult worse situation because her Snowdon house is partially built, making it harder to start from scratch with another builder.

The 26-year-old has spent $44,000 so far and was meant to move into her new home in March. However, only the slab and frame have been completed and she is still living with her parents.

Unfortunately, in the two years since she signed with Snowdon Developments, prices for home builds have gone up considerably, by as much as $50,000 or $100,000 or more in some cases.

“The prices are skyrocketing, I don’t have the funds to fork out another $50,000 for a build,” she told news.com.au.

Other homeowners, including Saurabh Mittal, 40, and Josh Curmi and his wife Alisha, aged 29, missed out on the government’s HomeBuilder grant because building work hadn’t started in time.

To meet the criteria for the government HomeBuilder grant, building had to have begun on their sites within 18 months of entering into the HomeBuilder contract.

Mr Mittal missed out on a $25,000 grant while the Curmis lost $15,000 in government money.

alex.turner-cohen@news.com.au

Originally published as Snowdon Developments collapses leaving 550 homes in limbo, $18m owed