‘Free fall’: Nightmare coming our way as iron ore price bottoms out

The golden goose of the Australian economy is taking a hammering and it could spell big trouble for everyday Aussies.

Mining

Don't miss out on the headlines from Mining. Followed categories will be added to My News.

The backbone of Australia’s export economy that generates a massive proportion of Australia’s tax dollars is in free fall as our most precious commodity — iron ore — sinks to worryingly new lows.

The red dirt is the golden goose of the Australian economy and pockets the nation $124 billion a year.

It is used to make steel, which in turn is used to create buildings, infrastructure, ships, trains, cars, machines and electrical appliances.

It’s all stuff that China smashes out in massive numbers and it means our two countries are bound together on iron ore in a mutual dependency.

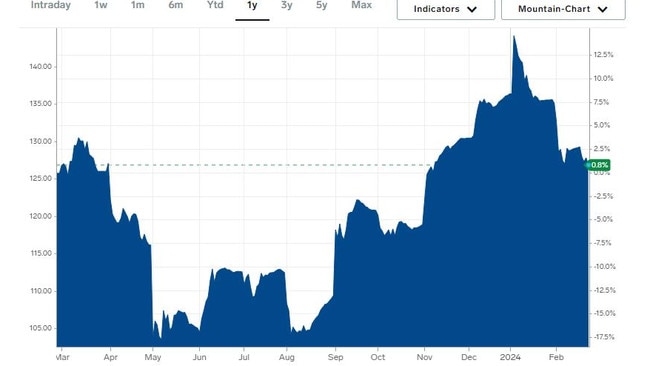

However, this week a major problem has hit the nation’s miners as iron ore fell to the lowest price since October — after dropping almost 9 per cent last week alone.

This is bad news for everyday Aussies as WA’s iron ore miners contribute a major proportion of Australia’s tax take — estimated to be nearly 18 per cent of the nationwide total tax income.

If you look back to the start of the year, it was estimated a multi-month surge in iron ore prices would deliver Treasurer Jim Chalmers as much as $18 billion in extra tax revenue.

This raised hopes of a second federal budget surplus and funding another round of subsidies for voters.

At that time, iron ore had rallied to $US145 per tonne, its highest price since April 2022. It was hoped that China’s economic recovery was gaining momentum thanks to a combination of monetary and fiscal stimulus.

However, expectations have now come crashing down as the money hasn’t been forthcoming from Beijing.

Bloomberg reports local governments in China have so far appeared reluctant or unable to borrow more. That’s fuelling expectations Beijing may pick up the slack and take on more debt.

As a consequence, the price has slid 12 per cent at the start of the year — with the price now sitting at $US127.

MB Fund and MB Super chief strategist David Llewellyn-Smith said iron ore was in “free fall”.

But it could get much, much worse.

The biggest concern outside of China’s woes is that an iron ore oversupply is likely to flood the market from next year as the massive Simandou mine in Africa starts exporting and delivering ore.

According to Forbes, a well-connected Australian fund manager said the increase in iron ore supply could potentially knock $US50 a tonne off the price, driving it down to around $US80.

If correct, the analysis of Yarra Capital could trigger a 49 per cent fall in the earnings of Aussie mining giants BHP and Rio Tinto and a 65 per cent fall in the earnings of Fortescue.

The slump in China has come at a bad time too given that March and April are typically busy months for construction.

In a move that is sparking concern Vale SA, the world’s second-largest iron ore producer, is looking to increase its sales outside of China. This means miners are worried China may not bounce back as previously expected.

In fact, experts say China’s economy is in the doldrums.

Losses on the Shanghai stock market on Monday came despite Beijing saying it wanted to boost sales of cars, appliances and other consumer products in “piecemeal incentives to stimulate the economy,” noted National Australia Bank senior currencies strategist Rodrigo Catril.

Government interventions have stabilised the market, with Chinese stocks rebounding from early February lows.

But underlying weakness means “investors are crying out for larger economic supports to be rolled out,” Moody’s Analytics economist Harry Murphy Cruise told AFP.

Market players are watching to see if extra spending and an ambitious growth target will be announced in March to help China’s economy gain momentum through the year, according to Mr Cruise.

In Australia meanwhile, the market has reacted poorly to the news coming out of China.

BHP’s share price has dropped 5.93 per cent in the past month and Rio Tinto’s has dropped 7.14 per cent over the same period.

Originally published as ‘Free fall’: Nightmare coming our way as iron ore price bottoms out