Filthy rich miners bring out begging bowl over Pilbara doom

Mega wealthy Aussies have banded together to beg governments after shock forecasts that leave them wanting.

Mining

Don't miss out on the headlines from Mining. Followed categories will be added to My News.

ANALYSIS

If we follow that maxim into iron ore, one could be forgiven for thinking that the apocalypse is nigh.

Major Pilbara miners banded together this week to give Australian governments a giant begging bowl in the form of a report by consulting firm ACIL Allen predicting Pilbara doom.

“The forward guidance provided by companies in the Port Hedland Port Supply Chain indicates that total iron ore production is forecast to steadily increase over the first half of the modelling period from approximately 544.8Mt (million tonnes) in 2022-23 to approximately 589.4Mt in 2027-28, before stabilising at this level over the second half of the modelling period,” the report authors said.

The value of production linked to Port Hedland, where most of the iron ore mined in Western Australia is loaded for export, is expected to peak at $89.2 billion in 2023-24.

The report forecasts a steep fall to $64.2 billion by 2027-28 and that the value of production will settle around the lower level until at least 2032-33.

In short, volumes will rise by 8 per cent, but the value will fall by 28 per cent, implying an iron ore price of $60-70 per tonne.

44Mt of new ore is not enough to crash the price, so what is really going on?

A far cry

This grovelling is a far cry from mining titans mounting utes with loudhailers to condemn governments!

In 2010, when miners overthrew the Rudd Government owing to threatened new taxes, they knew that the China story had years yet to run.

They were buggered if the Australian people were going to get their fair share of it.

But today, the boot is on the other foot. Although iron has not yet crashed, the majors know it is coming.

On the one hand, the China construction boom is over, and all we are waiting for is the shoe to drop:

On the other hand, the miners also know supply discipline has been lost at precisely the wrong moment, and massive new mines are scheduled to arrive over the next three years:

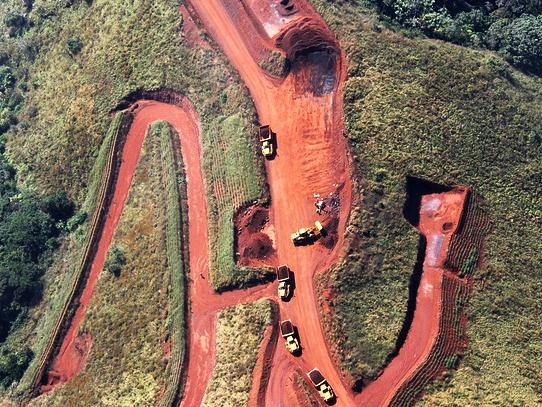

What Australians might find most galling about the big mining pre-crash begging bowl is that most of the new iron ore is not coming from Australia, even though the Aussie miners have been integral to producing it.

In particular, RIO’s Simandou monster project in Guinea, Africa, will launch late in 2025. The above chart includes roughly 27mt from Simandou, but there is more to that story.

Dubbed the “Pilbara killer”, Simandou ramps up to 120mt of iron ore per annum over three years, much of it owned by direct Chinese interests, helping break the BHP, RIO and Vale oligopoly.

Why would any Australian government respond favourably to RIO putting the begging bowl out now when its own African project represents a massive diversification away from Aussie iron ore for China?

The big miners should eat the gruel of their own making.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as Filthy rich miners bring out begging bowl over Pilbara doom