Everything you need to know as private health insurance premiums rise today

The overhaul will impact millions of Australians but many of us are still unaware of what we need to do. Here’s what you need to know.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

As consumers are flooded with advice to find the cheapest health insurance premiums as the overhaul kicks in today, experts are warning you need to be across exactly what will be covered by your fund.

NEW RATING SYSTEM

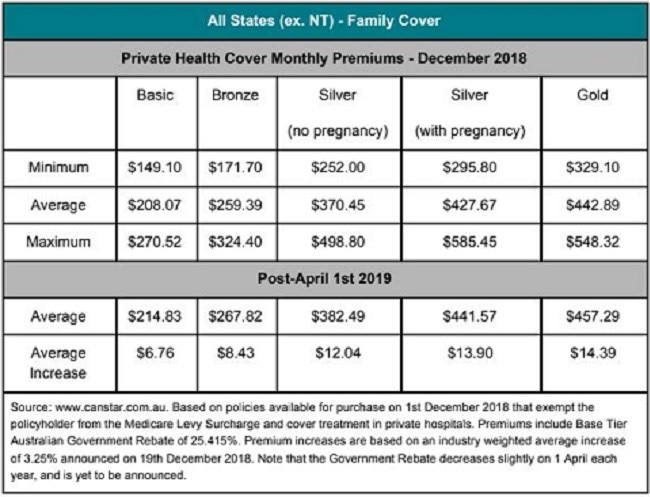

From today, private health insurance have gone up 3.25 per cent on average with four new tiers of hospital cover rolled out, classified as: Gold, silver, bronze and basic.

What is, and isn’t, covered in each category will be based on new minimum standards. For example, if heart and vascular system is covered in the category then it must cover everything listed in that category.

Basic plus, bronze plus and silver plus policies will cover at least one service more than what’s offered in the normal categories. For example, a silver plus policy could include cover for cataract surgery that would otherwise only be covered under a gold policy. Each insurer will vary in what extra they include on the plus package.

WHAT DO I NEED TO LOOK OUT FOR?

Private health insurance customers should have received an email or letter from their provider letting them know how their cover will change.

“This year, it’s really worth their time sitting down and having a look at what they’re actually paying for,” comparison site Finder insurance specialist Sophie Walsh told news.com.au.

“Some people will be better off, and they’ll have more treatments included in their policy, but others will actually be paying the same if not more for less cover.

“They could be hit with a nasty surprise when they turn up to hospital and find their treatment’s not covered under the new policy system.”

• ‘Played for dummies’: Sydney man saves nearly $3000 switching health insurance

• Australians slugged with ‘lazy tax’ of up to $2400 per year

• House prices falling faster than during global financial crisis

Those with diabetes, for example, need to be aware that insulin pumps are only covered as standard under the gold cover.

Similarly, those who need chronic pain management could be out of pocket because it might not be included if the consumer doesn’t have the top tier insurance.

“Senior Australians need to pay particular attention because cataracts and joint surgery is only included as standard on gold, the very top, cover,” Ms Walsh said.

“We don’t know the percentage of policies that are going to change, but we do know that there is a chance that if you don’t have gold level cover you could find that treatments are no longer included.”

BE SURE TO SHOP AROUND

Financial comparison site Canstar say the abundance of choices and range in the costs of each product mean “you’re mad” if you don’t shop around.

“The difference in premium for a gold style product — between the high and the low is $200 a month — that’s $2400 a year,” Canstar financial services group executive Steve Mickenbecker said.

Health insurance is complicated, Canstar admits, but the new policy tiers and the availability of online comparison tools means it’s easier for Australians to consider their options and choose a policy that works for them.

“A good start is to decide whether you need a gold, silver, bronze or basic level of cover,” Mr Mickenbecker said.

“Affordability obviously comes into this consideration. Then compare the individual policies

that fit into the chosen category for price and the benefits you receive.”

CONSUMERS WARNED ON HEALTH INSURANCE SHIFT

As comparison companies flock to offer advice on the best deals, consumer group Choice has warned any health insurance advice is “frankly dishonest”.

The group says a national survey shows 82 per cent of Aussie households are concerned by health insurance costs with the expenditure now the number one concern for families.

“We asked our Choice community to pitch in and help us understand these changes,” the group’s spokesperson Jonathan Brown said.

“What we found was a health insurance system in a state of mess.

“It’s frankly dishonest for anyone to say they can provide a true comparison of the health insurance market right now.

“New policies will be released over the coming weeks and months that will change in coverage and price.

“Until we have all the facts about the quality of cover in the market, no one can tell you what the best value for money policy will be for your needs.”

But price comparison website operator iSelect rejected this.

“We have worked closely with all the health insurers on our panel to make sure our comparison services reflect the upcoming changes,” iSelect Health spokeswoman Laura Crowden said.

“Customers comparing or purchasing health insurance through iSelect can be confident that the policy we recommend will meet their needs both today and after April 1, based on the customer’s current circumstances.”

WHAT ELSE SHOULD I KNOW?

• Youth discount

Insurers will be allowed to offer people aged 18-29 years discounts of up to 10 per cent on their private health insurance hospital premiums. They will be able to retain that discount until they turn 41 if they stay on the same policy. The allowable discount will be 2 per cent for each year a person is aged under 30.

• Rural help

People living in regional and rural areas can receive travel and accommodation benefits by insurers if they need to travel for special medical or hospital treatment.

• Cull on natural therapies

A range of natural therapies cannot be covered by insurers and will be removed, including homoeopathy, naturopathy, pilates, yoga aromatherapy and Bowen therapy.

• Higher excess exchanged for lower premium

People can increase their excess in exchange for a lower premium. The maximum excesses have been raised to $750 for singles (from $500) and $1500 for couples and family policies (from $1000).

— with AAP

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au

Originally published as Everything you need to know as private health insurance premiums rise today