Cost of living: How businesses are reeling in new customers

Consumer spending is down and so is the economic mood, but resilient small businesses are diversifying and innovating in order to reel in new customers – in some cases literally.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Consumer spending is down and so is the economic mood, but resilient small businesses are diversifying and innovating in order to reel in new customers – in some cases literally.

Printhie Wines vineyard in Nashdale, near the city of Orange in the NSW Central Tablelands, has taken a fresh approach by offering flyfishing along with a four-course degustation and wine tasting experience.

Marketing manager Emily Swift said the flyfishing was introduced to make use of the property’s natural resources and attract new customers, and it had been a resounding success.

“I think people are looking for that new experience,” she said.

“People are more discerning about how they want to spend their money, especially with the cost of living crisis, so you really have to think creatively about how you can entice them to engage with your brand and your product.”

Entrepreneur Sally Potocki, a former Olympian and Australia’s handball team captain, has pivoted from running a boutique website design agency, Creative Baguette, to launching her own skincare brand, Ambre Vernay.

Launching a new business in the current economic climate was a bit risky, she conceded, but the time was right.

“I think everyone in some way shape or form is feeling a bit of a pinch, but at the same time opportunities don’t come to those who wait,” said Ms Potocki.

“For us, we’re really passionate about [Ambre Vernay] and I think it’s better late than never.”

Ms Potocki said Creative Baguette’s clients, many of which are small businesses, had become more mindful but were still willing to spend money if it delivered value and benefit to their business.

“Every cent they’re spending, they need to be seeing something back from it.”

About 70 per cent of businesses have suffered a decline in purchase frequency over the past two years, while about half had experienced a fall in worker productivity, according to the Business Condition Survey by Business NSW.

The organisation’s chief executive officer Daniel Hunter said businesses were getting increasingly creative in the face of tough economic conditions, with some adopting artificial intelligence or investing more in customer experience.

“In short, times are very tough,” he said.

“These figures are alarming, yet it’s encouraging to see businesses demonstrating creativity and resilience to turn things around.

“For those that achieved productivity gains, success came from a mix of strategies: 70 per cent cited staff training, 31 per cent highlighted IT improvements, and 23 per cent credited AI solutions.”

“This data highlights that the path forward for SMEs [small and medium enterprises] hinges on innovation and investing in skills and technology.”

Council of Small Business Organisations Australia CEO Luke Achterstraat said small businesses were facing a deluge of costs amid a period of low consumer spending and increased regulatory burden.

“It’s a perfect storm of rent, energy, borrowing and insurance costs,” he said.

“You’ve got that cost price which is really hard for small business to absorb compared to larger enterprises and with no relief from interest rates, consumers are pulling back on spending and squeezing profits.

Total consumer spending fell by 0.7 per cent in the latest quarter of the financial year compared to the same period last year, according to Commonwealth Bank data.

And the rate of diagnosed mental health conditions among small business owners increased by 12 per cent to 34 per cent, according to a national work health and safety survey by the Australian Chamber of Commerce.

Optus small business vice president Emma Jensen said the sector was increasingly looking for community as an antidote to economic pessimism, citing recent research that found 45 per cent of businesses had considered closing down.

“When times are tough, just having people around to give advice [and] a sense of community connection I think is really important,” she said.

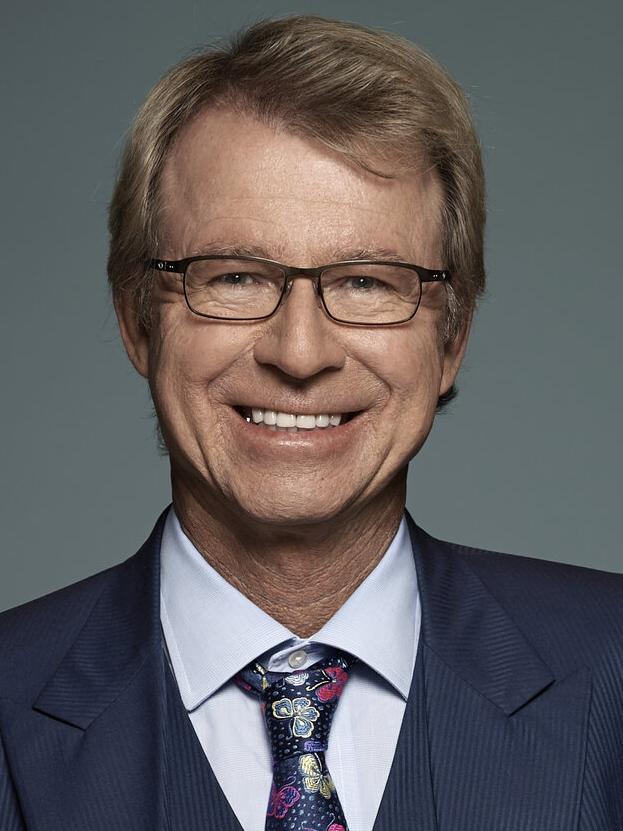

AMP chief economist Shane Oliver said businesses were currently operating within a constrained conditions but activity might increase next year if the RBA cut interest rates.

“It’s not as bad as it could be but it’s pretty constrained out there,” he said.

“Basically we still have high interest rates compared to the last decade and that is constraining consumer spending, especially on discretionary items, but when they’ve got a choice they’re trying to cut back.”

“Spending per person is going backwards at this stage. We’re still waiting for rate cuts but inflation has stayed a bit sticky,” Mr Oliver said.

More Coverage

Originally published as Cost of living: How businesses are reeling in new customers