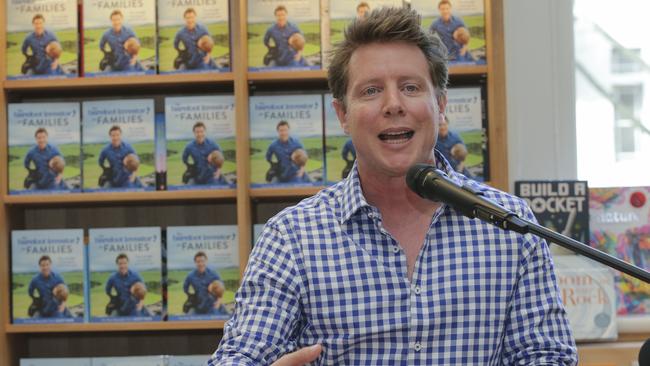

Barefoot Investor Scott Pape says kids’ should not be taught financial literacy by banks in school

Kids banking programs are under increased scrutiny and best-selling finance author Scott Pape says they are not helping children learn about money. ARE THEY DOING MORE HARM THAN GOOD?

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Controversial school banking programs such as Dollarmites result in students sticking with these banks as adults and fail to make them better savers, the corporate regulator has found.

And best-selling finance author, the Barefoot Investor Scott Pape, has slammed the programs, saying the Australian Securities and Investments Commission’s inquiry should bring “independent financial education” to the forefront, despite it being unlikely these programs will be banned in schools for good.

“What the inquiry should come back and find is that it makes about as much sense as having Australia’s largest credit card issuer (the Commonwealth Bank) teaching kids about money as it does to invite Ronald McDonald to teach them about food nutrition,” he said.

“Commonwealth Bank is not about financial education, they are about product flogging.”

Kids’ banking programs have come under fire on the way they are implemented and marketed to schoolchildren and used as a way to get kids to bank with institutions for life.

ASIC is now seeking input from the public and organisations on these programs as part its school banking review which started last year.

The consultation paper dubbed, Review of school banking programs, found the following:

• There is limited evidence among past students that banking programs have a lasting impact on their savings behaviour.

• School banking increases the changes of a participating student to stay with that financial institution after they finish school and progress to adulthood.

• There were concerns about the lack of digital interaction and poor interest rates on products.

ASIC Commissioner Sean Hughes said the review is expected to be completed by early 2020.

“It is important for ASIC to understand the range and extent of impacts that school banking programs can have on students, parents and school communities, as part of our responsibility to ensure the financial sector is delivering for all Australians and especially for future generations of financial consumers,” he said.

During the financial services’ Royal Commission CBA CEO Matt Comyn conceded he should have done more to delve into the illegitimate establishment of staff setting up children’s bank accounts so they could receive incentives.

MORE NEWS:

Trump sought Morrison’s help to smash Mueller: report

US politician quits over Aussie ‘insider trading’

Guy Sebastian to host ARIA Awards

Prince Andrew arrives in Australia amid scandal

Prince Andrew arrives in Australia amid scandal

Staff were revealed to be using their own money to activate accounts set up for school banking which counted towards their sales targets.

A CBA spokeswoman said in an issued statement the bank “has a strong and respected track record of providing quality financial education programs in Australia and we are always looking at ways we can improve our financial education programs”.

Consumer finance expert Lisa Montgomery said kids accounts were “not teaching kids about money and the importance of it”.

“Where that does start is at home,” she said.

“There are gimmicks attached to them or something that’s attracting and for us as kids it was the money box.”

Mr Pape has urged parents to visit barefootmoneymovement.org.au and lodge their concerns about banks teaching kids about money in schools.

The deadline for filing submissions is October 31.

KEY POINTS

• 60 per cent of Australian primary schools participate in school banking programs.

• Banks can contact schools to participate in a school banking program or parents groups may contact the banks to get a program in their school.

• School banking accounts enable student to deposit money into their accounts via the school, usually weekly.

• In October 2018 ASIC announced a review into school banking programs which is due to be completed in early 2020.

Originally published as Barefoot Investor Scott Pape says kids’ should not be taught financial literacy by banks in school