Banks rip off $3.49 billion from credit card users with high interest rates

THE big four banks’ failure to pass on official rate cuts to credit cards has fleeced Australians of $3.49 billion, or $220 per customer.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

EXCLUSIVE

BANKS’ failure to pass on official rate cuts to credit cards has fleeced users of $3.49 billion, or $220 per customer.

These new findings come from consumer advocacy group Choice, which is hoping bank CEOs will be interrogated about their inaction on interest rates at a parliamentary inquiry in Canberra today (Tuesday).

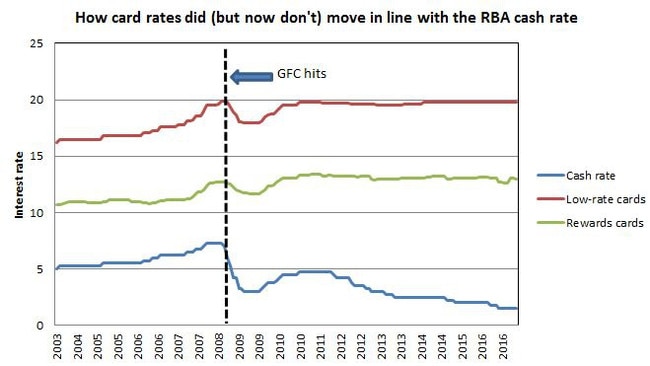

Since 2011, the Reserve Bank of Australia cash rate has fallen from 4.5 per cent to 1.5 per cent. Yet the average credit card rate has barely budged over that time, moving from 17.41 per cent to 17.35 per cent.

RELATED: CBA set to give credit cardholders the power to shut account online

Banks argue there is little link between RBA movements and card rates.

“But there was until 2011,” said Choice’s head of campaigns and policy Erin Turner.

RELATED: Extent of credit card rort revealed

In 2015 a Senate inquiry examining credit card interest rates was told by bankers that there were growing cost pressures from “value-added services and rewards schemes”.

Choice’s Ms Turner said examining interest charges for “low-rate” card” showed the bankers’ argument was bogus. Low-rate cards don’t have rewards programs yet their rates haven’t fallen either.

“There is an extreme and growing differential between the cash rate and low-rate cards, with the exception of ANZ’s,” she said.

As first revealed by News Corp Australia, ANZ lopped two percentage point from its low-rate card last month. Ms Turner said the move was “tokenistic” and that it was time for politicians to legislate to make it harder for banks to avoid telling consumers about rates and fees and easier for consumers to exit costly products.

The Labor Party’s financial services spokeswoman Katy Gallagher said the Government had promised action on credit cards in May last year but done nothing.

“We have known for a long time that credit card holders are getting a raw deal from their banks when it comes to interest rates and other hidden fees and charges and this data from Choice just reinforces why it’s essential that we see action from the government on credit cards as a matter of urgency,” Ms Gallagher said.

Small Business Minister Michael McCormack, who is responsible for consumer affairs issues, said Federal Government was “progressing” changes that would “improve consumer outcomes and competition in the credit card market”.

These changes, among other things, eliminate some of the worst tricks card providers use to charge extra interest and make it simpler to close an account.

“If customers are not satisfied with their current interest rates, they should shop around, including with customer-owned banks and credit unions,” Mr McCormack said.

Australian Bankers’ Association retail policy executive director Diane Tate said the RBA cash rate was not the price that banks paid for the money they on-lend. The cost of funds sourced here and overseas was subject to global financial conditions.

Ms Tate added: “Credit cards come with a range of different features which contribute to their cost, including rewards programs and interest-free periods. Banks spend a lot of money on keeping credit cards safe and secure from fraud.”

Many people pay no interest on their credit cards because they repay the debt in full each month.

Follow this reporter’s work on Facebook via this link and on Twitter here

Originally published as Banks rip off $3.49 billion from credit card users with high interest rates