‘Don’t care’: More bank branches to close

The major banks are shuttering more bank branches across the country with calls for them to stop as they rake in “massive profits”.

The major banks are shuttering more bank branches across the country with calls for them to stop as they rake in “massive profits”.

The RBA board is in for another tough call on the cash rate in its May meeting, with upcoming inflation data to weigh heavily on the decision.

The big four have been heavily criticised for their “tight-fisted and mean approach” when people lose millions to scams, which they are also failing to prevent.

Australia’s big four banks have come under fire for failing to stop customers losing hundreds of millions of dollars to scammers. See what else the scathing report revealed.

The billionaire says the tight lending restrictions is a bigger issue facing the property market than the cutting or hiking of the official interest rate.

The nation’s leading consumer law firm is taking matters into its own hands by threatening to make banks pay up, writes Joe Hildebrand in this exclusive.

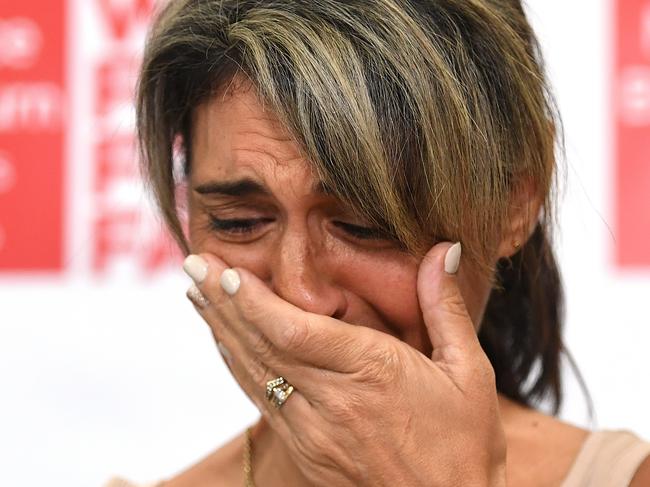

Michelle and Ian Tate were on a single income when Westpac lent them more than $1.8m. Now they’re about to lose it all — and they’re suing the bank.

Labor has revealed the cornerstone of its response to the banking royal commission — an “unprecedented” scheme to compensate customers.

A French court has ordered Swiss bank UBS to pay a record $6 billion in fines for helping wealthy clients evade tax authorities, wrapping up one of the biggest-ever tax evasion trials.

Treasurer Josh Frydenberg has dismissed a Labor plan to grill bank chiefs twice a year on their progress implementing royal commission findings as the ‘latest attempt to appear tough’.

He came under withering fire during the royal commission. Now NAB chief executive Andrew Thorburn is getting a golden handshake.

Scott Morrison has criticised Labor’s push for him to make changes after the banking royal commission before the federal election.

A wheelchair-bound mother has been refused a bank loan after a bungle with her financial details that left her with black marks against her name that didn’t belong to her.

A major bank will become the first of its kind to issue its own form of crypto, less than 18 months after its boss said the form of currency was “stupid”.

Original URL: https://www.adelaidenow.com.au/business/companies/banking/page/193