Aussies warned about scammers next month

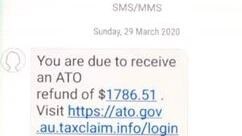

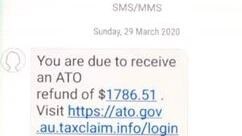

Australians are being warned to be vigilant over the next few months as scammers are expected to be out in force.

Australians are being warned to be vigilant over the next few months as scammers are expected to be out in force.

The average Aussie could risk losing more than $2000 in twelve months by making one simple mistake with their finances.

Three of the four big banks have now changed their interest rates for mortgage holders and some saving accounts.

The major bank has posted a staggering profit on the back of surging interest rates – and has predicted what’s next for the economy.

The housing market was a big issue during the election so now it’s over, everyone wants to know what happens next to prices.

Anti-money laundering experts reported ‘suspicious activity’ from accounts linked to Donald Trump and his son-in-law Jared Kushner.

Banks, insurers and super funds will have to deal with customer disputes in as little as half the time as well as formally address grievances made via social media.

Many had speculated cryptocurrency was dead, but a recent rally might show there’s still life left in the cash alternative.

It’s the businessman’s version of a young professional’s customised water bottle, and apparently demand for the product is high in Australia.

The slog to save for a home loan deposit might be a thing of the past thanks to one lender. But there’s a catch.

One of the biggest Bitcoin company’s in the world has suffered a “large-scale security breach”.

The fallout from the banking royal commission has cost Westpac about $1.45 billion.

One of Australia’s big four banks announced a cash profit lift but flagged a weakened housing market and home loan fees for its forecast.

Scott Morrison has reached out directly to mortgage brokers warning them of the risks of a Labor Government.

Original URL: https://www.adelaidenow.com.au/business/companies/banking/page/190