Depressing reason Aussie banks made $44.6 billion in pre-tax profits last financial year

A whistleblower who triggered a royal commission into Australia’s big four banks says “nothing’s changed”, as new analysis exposes the source of their immense profit.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

The big four banks are among the most profitable in the world because their market dominance allows them to “gouge” Australians on home loans, a leading economist says.

Last week three of the four major banks revealed multi-billion half-year profits, including a record mid-year mark for ANZ.

Senior economist Matt Grudnoff, however, believes Aussies should “absolutely be concerned” at the levels of cash the banks are making – which he says comes in no small part from mortgages.

Analysis by Mr Grudnoff’s employer The Australia Insitute, released in October, found $17.6 billion of the $44.6bn the big four made in pre-tax profits came from loans to owner-occupiers.

Researchers estimated a household with an average mortgage of $574,200 would contribute $200,800 over 30 years purely to the bank’s profit, equating to about 35 per cent of the loan.

Mr Grudnoff said a “distinct lack of competition” has allowed the big four’s profits to soar among the highest of any banks in the world despite Australia’s small population.

“Because Australia’s banking system is dominated by the big four they are just able to gouge their customers for more money,” he told news.com.au.

“And I mean, there’s no reason to think that the big Australian banks should be some of the most profitable in the world.

“Australia is a rich country, but we’re only small relative to some other nations, and yet we have some of the most profitable banks in the world.”

His comments came after Kevin Doodney, an Australian housing futurist at the High Yield Property Group, went viral after calling out how the big four were among the “eight most profitable banks in the world”.

“What the Australian public needs to ask is, how on Earth can that be possible?” he said.

“Because, I think the Australian people are going to look at that and go, ‘nah, that’s not possible’.”

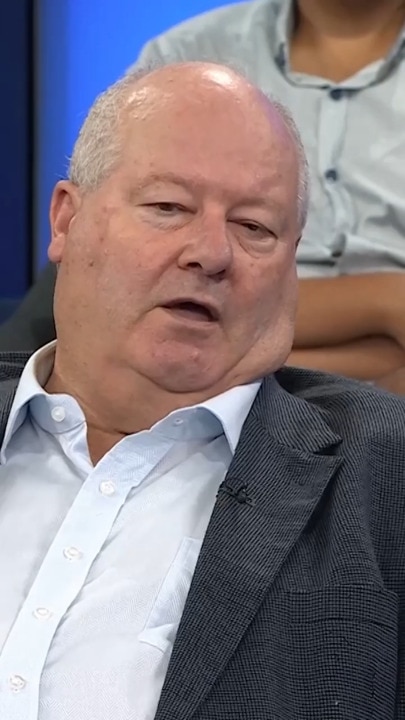

Jeff Morris, an ex-Commonwealth Bank employee who blew the whistle on misconduct inside the bank’s former financial planning wing, believes “only window dressing” had been applied to the organisations since the banking Royal Commission his story helped instigate.

“Nothing’s changed in reality,” he told news.com.au.

“In fact, I think they’re treating people with more blatant disrespect than ever.

“I think the customers have become … it’s as if we’re just little AI bots or something of no significance at all.”

Mr Morris cited an example of his dealings with his own bank and the lack of customer service, saying he was left waiting for hours to speak with someone on a hotline.

“It’s very clear to me that there’s a vast gap between the rhetoric put out for public consumption and the way they actually treat their customers on the ground, and that’s is a fundamental dishonesty and lack of any integrity,” he said.

“And that, I think, means that they will always revert to this habit of ripping people off.”

Mr Morris said he did not have a problem with banks making large profits, although he does have an issue with the huge paydays received by bank executives.

ANZ last week announced record half-year revenues of $10.99bn and $3.64bn net profit after tax, a jump of about 16 per cent.

NAB recorded a $3.6bn profit in the same period, and Wespac’s $3.5bn net profit in the six months to March was down one per cent on last year.

The Commonwealth Bank said in February its mid-financial year results showed a $5.13bn cash profit – six per cent higher than in 2024.

The Australian Banking Association, which works to help the community understand the banking industry, said in a statement that profitability meant banks could offer cheaper loans to clients.

“49 per cent of banks are owned directly by households or through their super, so it’s in everyone’s interests that they remain profitable and competitive,” a spokesperson said.

“Strong and profitable banks also mean they can borrow funds at reasonable rates on global markets to lend to Australians.

“Low or no profits would mean banks have to pay more for the money they borrow to lend to Australians – and that would mean more expensive home loans for mums and dads and small business owners.”

The big four banks were contacted for comment.

Economist Saul Eslake told Australian Broker that although the banks made huge profits, they also paid large taxes and post-tax dividends to shareholders.

“For the regular person, the billions that the banks report in profits are a lot of money,” he said.

“But when set against the size of their assets as a percentage, or when you consider how much of those billions are returned to the federal government as a form of company tax and to ordinary shareholders, including through their superannuation funds in the former dividends, the Australian people do all right out of it.”

Mr Grudnoff acknowledged that Australian banks paid vast amounts of tax and were the largest tax contributors of any industry in the country.

But, he said, that was “part of the problem” as it revealed how “extremely profitable” they were and argued taxpayers should see a greater share of the dividends.

“And if there was more competition, if banks weren’t able to gouge us, that’s enormous amounts of money that would be in households pockets rather than in the bank,” he said.

“So this is a massive issue and it should be a far bigger issues than it actually is.

“And I think in part it’s not because it’s wrapped up in our house prices and interest rates and people don’t really understand it, and it’s kind of hidden from view.

“But otherwise, I think people would be outraged if they knew how much profit our banks were making off them.”

Originally published as Depressing reason Aussie banks made $44.6 billion in pre-tax profits last financial year