Customers left fuming over big four bank’s branch closure

Customers have slammed a big four bank for its “outrageous disregard” after it closed a local branch, forcing them to drive 1.5 hours to do their banking.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

ANZ customers in the Blue Mountains are furious after the bank decided to close the only branch in the area, forcing them to drive nearly 150km to the nearest option.

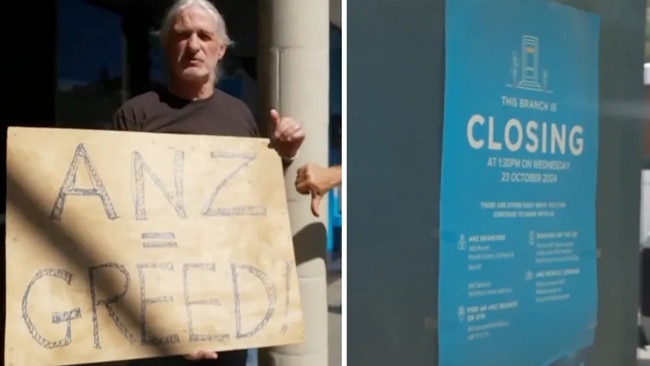

Customers have been counting down for months and even staged an 11th-hour protest outside the Katoomba branch on Tuesday hoping ANZ would reverse its decision.

Local activist Kim Grace said residents who live in Mount Victoria will be asked to travel for hours to do their banking following the closure of the branch on Wednesday.

“This is not just an inconvenience; it’s an outrageous disregard for customers from a bank that reaps significant profits,” he said.

“What is also disappointing is that proper consultation with affected communities like ours does not get a mention.”

“The ANZ bank owes us an explanation, an apology for the distress and inconvenience it has caused by an illegal act, and the immediate removal of our branch closure notice.”

ANZ said in a statement that transactions in their branches have halved over the last five years, with just 1 per cent of all transactions being done over-the counter and almost 4 million customers using mobile apps instead.

“Since we announced the closure of the branch earlier this year we have been working with our Katoomba branch customers to ensure they are well supported and aware of all the ways they can complete their banking, including utilising nearby branches, local atmx ATMs, phone banking, or our team of community-based bankers, like mobile lenders,” ANZ said in a statement to NewsWire.

Part of a growing trend

ANZ’s branch closure follows a burgeoning trend of moving away from traditional banking services to online.

Nearly 800 bank branches have been closed in regional areas between 2017 to 2023, according to the Australian Prudential Regulatory Authority.

The big four Australian banks have removed 217 ATMs in the past 12 months and a staggering 8,338 bank-owned ATMs in the past seven years.

Bank branches are also becoming a thing of the past, with Aussies losing access to 230 banks in the last financial year and a total of 2,334 in the past seven years.

Combined, the number of bank-owned branches and bank-owned ATMs has halved in seven years from 19,508 to 8,836 as at 30 June 2024, meaning Australia’s banks have dismantled half of their cash distribution network.

While Aussies’ ability to access cash is falling, figures from the Reserve Bank of Australia (RBA) show the number of withdrawals from ATMs in Australia jumped 2.7 per cent from roughly 28.7m in July to 29.4m in August.

Cash Welcome founder Jason Bryce said there have been around one million ATM withdrawals made in Australia every day over the past two years.

“Banks have closed half of their bank-owned ATMs and branches in seven years, restricting our access to cash,” he said.

“Australians continue to want cash so banks have no excuse for continuing to close branches and ATMs.”

Originally published as Customers left fuming over big four bank’s branch closure