rural MP Bob Katter rages after bank’s latest attack on cash

Maverick MP Bob Katter has joined the chorus of criticism against CommBank for imposing a $3 fee to withdraw cash from some accounts.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Bob Katter has slammed the Commonwealth Bank’s controversial decision to slug customers a $3 transaction fee for withdrawing cash.

“I think that it’s an act of defiance and contempt for the people of Australia,” he told Channel 10’s The Project on Tuesday.

Mr Katter said the decision was a counter attack against the growing movement to enshrine the accessibility of cash, which he says left the banks “very surprised at how successful we’ve been.”

“So they’re attacking now against the government who is moving to enshrine cash,” he said.

Mr Katter said people had the right to use their own money as they wished.

“Now, I’d feel a lot more comfortable if I had a big giant safe somewhere that no one could break into or put a gun to my head to get into, than leaving it with a bank,” he said.

“In fact, I feel very insecure at the banks.”

The Member for Kennedy has long been a staunch defender of the right to use cash, making headlines in February when a cafe at Parliament House refused to take his $50 note as payment for a plate of fish and vegetables.

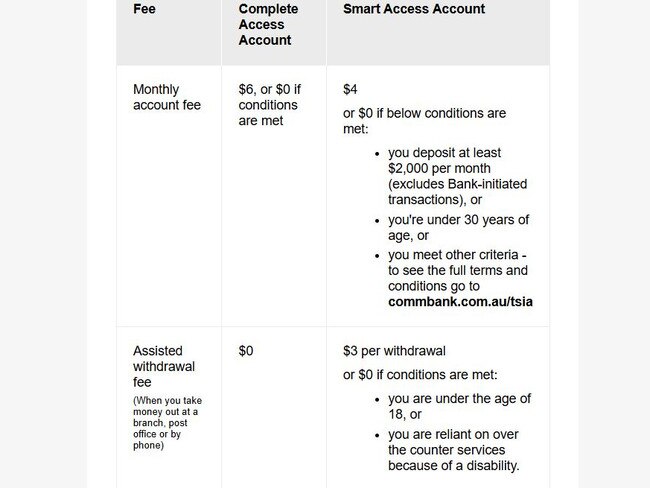

The Commonwealth Bank informed customers this week that it would close its Complete Access Account and move customers to its Smart Access Account.

The new account from January 6 will include a $3 fee tacked onto every withdrawal at a branch, a post office or by phone.

These will be void if customers are under the age of 18 or are reliant on over-the-counter services because of a disability.

“We’re getting in touch to let you know that after reviewing our transaction accounts that are no longer on sale, we have decided to close our Complete Access account. On or after 6 January 2025, your account will change to a Smart Access account,” Commonwealth Bank said in an email to customers.

In a statement to NewsWire, Commonwealth Bank said CBA continued to offer customers free cash withdrawals from its national ATM network.

“Our Smart Access account has a $3 assisted withdrawal fee. This is our main transaction account and the assisted withdrawal fees on that account have not changed,” they said.

“we continue to offer waivers on assisted withdrawal fees for customers who meet certain criteria, including certain types of pension recipients and those under 18 years of age.”

While Commonwealth Bank insists it has no plans to go cashless, it has opened

“specialist Centres” that do not have tellers that handle physical cash.

Instead, these specialist centres focus on business and home loan products, credit facilities and merchant services.

The move comes after the company’s full-year announcement that it was spending $410m on cash services for the year ending June 2024. Of this, about $350m was cash on hand.

The $3 fee has angered customers, with hundreds taking to social media to vent their frustration.

“If this does happen, I will be closing all of my accounts, so will my husband and daughter,” one person said.

“Being charged to get your own money is just plain wrong, talk about reverse bank robbery. Come on Commonwealth bank do better,” wrote another.

“Like they aren’t making enough profit! I might search for another bank,” another wrote.

“What a scam.”

Customers forced to travel hours just to find an ATM

Commonwealth Bank is not alone in changing Aussies access to cash.

Australia has revealed grim news for those still relying on hard currency.

Almost 450 branches and ATMs shut down in the last financial year alone, after more than half of the nation’s ATMs were wiped out over five years, amid the banking sector’s move towards increasingly digital operations.

A separate report, published by financial research agency Canstar, found that while regional bank branch closures had slowed, 52 of 230 branches closed last year were regional. The year before, 112 regional branches were shuttered.

“If you ask anyone who was relying on those 52 branches to do their day-to-day banking, they won’t exactly be chalking this up as a win,” Canstar data director Sally Tindall said.

Meanwhile a senate inquiry in March showed regional and rural parts of Australia were particularly vulnerable to a cashless society.

Remote Australians are flying to the city with suitcases full of cash to make deposits after a local bank closed, while reports of robberies, scams and elder abuse are rife, an inquiry has been told.

One example of this was residents in west Sydney have been left fuming after two of Australia’s major banks confirmed they would be axing local branches without any warning.

Every day, residents, small business owners and families walk into the Doonside Commonwealth Bank of Australia (CBA) branch in Greater Western Sydney, which has been serving the community for close to 60 years for their banking services.

In a recent statement Blacktown MP Stephen Bali said between 2018 and February 2024, CBA has closed more than 350 branches across the country and in the last five years, have axed 54 per cent of its ATMs.

In recent comments to NewsWire, Bali said the suburb is home to “approximately 10,000 people aged over 60 or people identified with long-term chronic health issues” who are now “being forced to travel return trip of at least half-hour to a major shopping centre to undertake their banking needs”.

Originally published as rural MP Bob Katter rages after bank’s latest attack on cash