Bank customers claim they are being ‘punished’ with high fees for branch use

Charging exorbitant fees for one particular service is the latest tactic Australia’s biggest banks are using to drive customers from branches, some have claimed.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

EXCLUSIVE

Charging exorbitant fees for over-the-counter transactions is the latest tactic being used by some of Australia’s biggest banks to discourage branch transactions, customers have claimed.

As reported by news.com.au, former ANZ employees have alleged that the bank is forcing customers out of branches and then using their absence to justify branch closures.

The previous allegations centre around tactics the bank uses to divert branch customers away from tellers and instead to ATMs or iPads to complete transactions, allowing the bank to avoid counting them as in-branch transactions.

Customers and employees of Australia’s other Big Four banks have also alleged that Westpac, Commonwealth Bank (CBA) and NAB engage in similar tactics.

But the latest allegations come after several business customers contacted news.com.au to reveal the fees they are being charged for teller assisted transactions.

One angry customer told news.com.au that “for our auditing process and to maintain ISO9001 standards we must have our cash deposits stamped by our ‘home’ ANZ branch”, despite the fact that this means the business incurs additional fees.

The trade business owner, who asked to remain anonymous, added: “Yes, that’s right, a fee to deposit cash into a bank”.

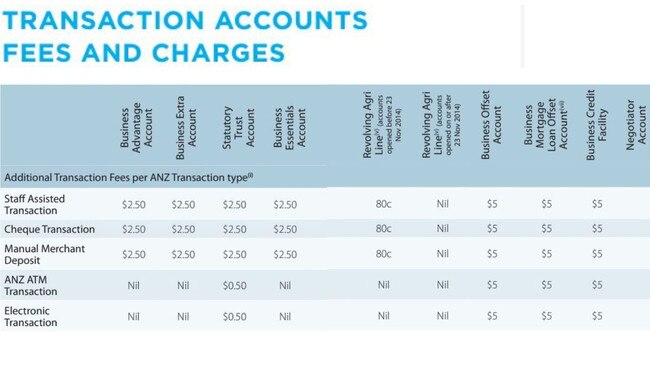

According to its business account terms and conditions document, ANZ charges between 80c to $5 for a staff assisted transaction.

It defines staff assisted transactions as withdrawing cash over the counter, a funds transfer over the counter whether to an ANZ account or another bank, depositing cash or a cheque over the counter, deposits using fast deposit bags or envelopes, or “any other withdrawal or transfer from, or deposit or transfer to, you ANZ account that is manually processed by ANZ staff that ANZ determines to be a Staff Assisted Transaction”, depending on the account type.

An ANZ spokesperson defended its fees, telling news.com.au: “We ensure that our fees and charges are competitive with others in the industry”.

The manager of an IT business, which also banks with ANZ, has described being charged fees for an over the counter service he required due to problems with the ATM at his local branch.

Speaking to news.com.au on the condition of anonymity, he said: “When I am depositing a cheque (a $2.50 fee) and the ATM keeps spitting it out (which happens often) and then I need to see a teller, I get the double whammy of fees ($5) just to be able to deposit a cheque”.

“I have also been in the situation when the ATM has no paper left to print a receipt, which I need for bank reconciliation at the end of the month for my business, so I have to go to see a staff member to manually print me one,” he said, for which he also incurred a $2.50 charge.

“I can’t tell you the number of times I have argued the point about why I shouldn’t have to pay a fee when the machines [ANZ] are directing me to use function incorrectly yet I have to be punished with a fee to resolve the issue.”

The owner of a hospitality company with several businesses who banks with CBA, told news.com.au of the huge amount in fees she was being charged to deposit the cash takings from her businesses over the counter in-branch every day, which she did “for ease of reconciliation for the accountant”.

“CBA charge $10 – yes $10 – for each banking bag. That’s one a day each week, so $70 per week per business to count our daily takings!”

The owner, who declined to be named, said that when she has asked bank staff about the fees they have said, “nothing they can do – use the ATM”.

“I think $10 a bag is a bit much so I refuse to pay that and now only use the ATM for which there is no cost.”

As a result of the large fees she said she is now stockpiling the takings and depositing them via ATM – both of which present a security risk in an area she describes as having “quite a lot of crime”.

“Twice a week I walk to the bank with 3-4 days takings – it’s too dangerous for my staff to do it – for each business. That’s thousands of dollars each time.”

“I stand at the ATM doing deposits hoping nobody realises what I am doing with $10,000 plus in my bag.”

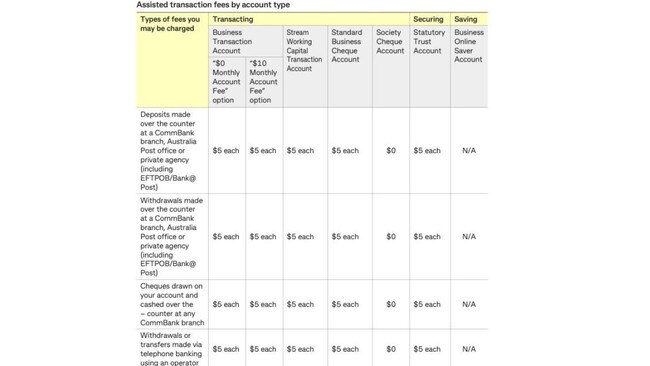

According to its business account terms and conditions, CBA charges a $10 fee per transaction for deposits made via its “Quick Deposit Box” or “QuickCash envelope banking” for most of its business accounts, a $5 fee for the deposit of cheques and a $5 fee for deposits or withdrawals made over the counter at a CBA branches or Post Offices.

A CBA spokesperson told news.com.au that “branch staff have discretion to waive assisted withdrawal fees associated with their products” such as when an ATM is malfunctioning.

According to its terms and conditions, Westpac charges business customers a fee of between $2.50 – $5 for staff assisted withdrawals, deposits and cheque deposits, depending on account type.

NAB, meanwhile, charges $2.50 – $3.40 for banker assisted deposits or withdrawals including those made by cash or cheque, on most of its business accounts, according to its terms and conditions.

A NAB spokesperson said that in the event a transaction had to be processed manually due to a technical issue with an ATM beyond the customer’s control, its banker assisted fees would be waived.

By contrast, the majority of ATM transactions are fee-free for business customers of all the major banks.

Know more about this story? | michelle.bowes@news.com.au

Originally published as Bank customers claim they are being ‘punished’ with high fees for branch use