Will you get the rate cut? Big banks announce plans

ANZ and Westpac are two of the big four banks that have refused to reduce variable mortgage rates following the Reserve Bank’s cash rate cut.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

ANZ has refused demands from both sides of politics to pass on the Reserve Bank’s rate cut in full, announcing it will lower its interest rates on mortgages by 0.18 percentage points instead of the full 0.25.

The major lender was the first of the big four to pull the trigger and cut its interest rates on mortgages, less than 10 minutes after the RBA announced it would slash rates to 1.25 per cent this afternoon.

The Commonwealth Bank, however, announced it would pass on the rate cut in full, reducing its interest on mortgage customers by 0.25 per cent.

NAB said shortly after it too would pass on the cut to “the lowest it has been in more than 40 years”. Banking experts had tipped Westpac to follow suit. But tonight the bank said it would not pass on the full cut to its customers.

Westpac’s chief executive of consumer, David Lindberg, told Fairfax: “We are operating in a historically low interest rate environment, which creates the opportunity for home-owners to get ahead on their repayments.”

Following the Reserve Bank’s cash rate decision, we will reduce all of our Standard Variable Rate home loans by 0.25% p.a. This will take effect from 25 June 2019.

— CommBank (@CommBank) June 4, 2019

ANZ retail boss Mark Hand acknowledged many borrowers would have hoped to benefit from the full cut, but said the bank had other considerations.

RELATED: RBA slashes cash rate to all-time low of 1.25 per cent

RELATED: Winners and losers from interest rate cut

The bank’s net interest margin — the difference between interest charged on a loan and that paid to fund it — has been squeezed in recent times.

“In making this decision, we have weighed up a number of factors, such as business performance, market conditions and the impact on our customers, including our depositors,” Mr Hand said.

“While we recognise some home loan customers will be disappointed, in making this decision we have needed to balance the increased cost in managing our business with our desire to provide customers with competitive lending and deposit rates.”

The bank announced last month its half-year cash profit had lifted to $3.56 billion, up 2 per cent from a year earlier, despite saying it faced subdued growth and increased competition.

ANZ’s standard variable rate for owner-occupier principal-and-interest loans will fall to 5.18 per cent, with the interest-only rate coming down to 5.91 per cent.

Treasurer Josh Frydenberg condemned the bank’s decision to pass on only a partial cut, invoking the damning findings of Kenneth Hayne in the banking royal commission.

“We heard from Commissioner Hayne just months ago that the banks were putting profits before people,” he told reporters shortly after the move was announced.

“Actions like this don’t give the Australian people any comfort that the banks have changed their behaviour.

“I think the ANZ has let down its customers. This is deeply disappointing from the ANZ.”

In contrast, smaller lenders Athena, RACQ and Reduce Home Loans have announced they will pass on the full 0.25 per cent cut.

.@JoshFrydenberg on RBA lowering interest rate: This rate cut will be welcome news for Australian households and businesses.

— Sky News Australia (@SkyNewsAust) June 4, 2019

MORE: https://t.co/RkybpqFUvJ #SkyLiveNow pic.twitter.com/P3STNqJHvd

Comparison site Canstar said it was “incredibly disappointed” ANZ had refused to pass on the cut so quickly after the RBA’s announcement.

“Having put a rate increase through in September because wholesale funding rates had gone up, now they’ve gone back down and we thought there was room to pass on a 25 basis point cut,” the site’s finance expert Steve Mickenbecker told news.com.au.

“Given the environment, it was an opportunity to demonstrate the world has moved on and changed post-royal commission.”

“We’re anticipating and hoping that other majors will pass on the full 25 points.”

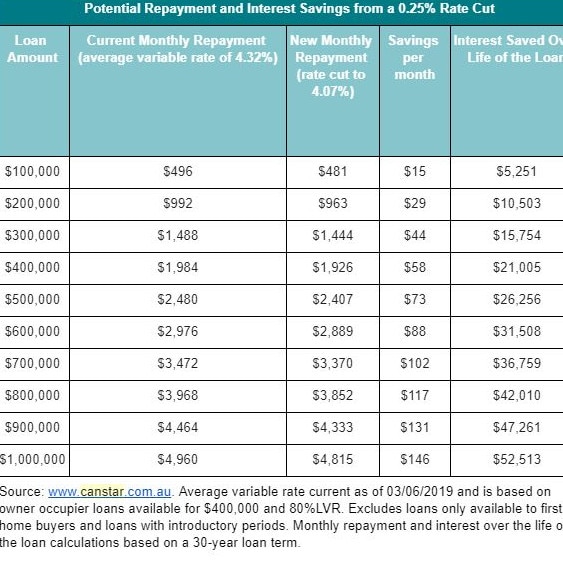

Canstar figures say borrowers will save nearly $90 a month from the reduction in mortgage repayments on a $600,000 loan when the 0.25 per cent cut is factored in.

But CoreLogic head of research Cameron Kusher said in a tweet consumers wouldn’t make any savings on their mortgages unless they contacted their bank and ask for the repayments to be reduced.

“Otherwise you pay the same on your mortgage but the portion going to interest repayments reduces and you pay off more of the principal,” he said.

This will allow borrowers to pay down debt faster, Mr Kusher said.

Otherwise you pay the same on your mortgage but the portion going to interest repayments reduces and you pay off more of the principal this paying down the debt quicker 2/

— Cameron Kusher (@cmkusher) June 4, 2019

In announcing it would pass on the full 0.25 per cent cut to borrowers, NAB said in a statement the decision would provide more money in household budgets for other expenses.

“We strongly believe reducing rates is the right thing to do by our customers and reflects our focus on earning trust in the community and rewarding our loyal existing customers,” company chief customer officer Mike Baird said.

“NAB is determined to continue supporting our home loan customers by being a bank they can rely on throughout the lifetime of their loan.”

NAB will reduce all Standard Variable Rate home loans by 0.25% per annum, making our rate the lowest it has been in more than 40 years.

— NAB (@NAB) June 4, 2019

RBA governor Philip Lowe cited poor employment growth and weak inflation as the reason for the cut.

“Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy,” he said in his statement.

“It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target.

“The board will continue to monitor developments in the labour market closely and adjust monetary policy to support sustainable growth in the economy and the achievement of the inflation target over time.”

— with AAP

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au

Originally published as Will you get the rate cut? Big banks announce plans