$3.1m owed to workers of collapsed company La Fortuna

Ben, 44, got the shock of his life when colleagues told him to check his pay slip. He’s part of a $3.1 million problem.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

A company that provided “security services” to public schools has gone into liquidation with more than $6 million in debt, with employees owed the bulk of the money.

Months later, the workers from Western Australia face a desperate battle to recover their superannuation, which a whopping $3.1 million owed to employees.

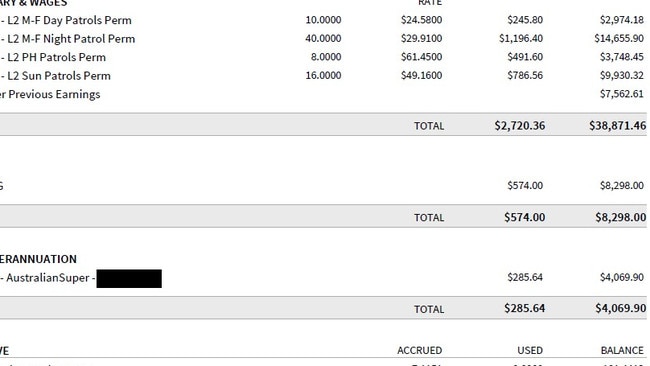

Superannuation payments had appeared on their pay slips but the money wasn’t actually being deposited into their accounts for a period of time.

The company, La Fortuna, which was trading under the name Australian Guards and Patrols, went into liquidation in November last year with more than 50 employees terminated on the spot.

It provided security services to both WA public schools and TAFE campuses.

The Australian Taxation Office lodged a claim for the $3.1 million worth of superannuation, a report from liquidators filed in February with ASIC revealed.

The report revealed employees had claimed for unpaid entitlements with sums as high as $62,000.

Ben* worked as a security guard for a year before Australian Guards and Patrol collapsed. While his pay slips showed he was being paid superannuation, the money wasn’t being deposited into his account on many occasions.

The 44-year-old only learned about the issue when other colleagues raised it and told him to check his super balance midway through last year.

He estimates based on his pay slips that he has lost out on $5700 worth of super and despite lodging a claim with the ATO in July last year, he still hasn’t seen a cent.

With compound interest, that figure would be worth up to $42,000 to Ben’s superannuation in 20 years.

Lack of government oversight

Ben is particularly concerned as Australian Guards and Patrol was contracted by the WA Department of Education to provide the security services.

He believes the government should have checks and balances in place to ensure third-party staff are being paid properly.

“The Department of Education should hold some liability as they renewed (the) contract during the time we weren’t getting paid our super,” he noted.

“It must be a compliance side of it as they should check on us to make sure we are getting paid right if we are under their roof.”

WA Department of Education deputy director of general, education business services, Jay Peckitt, said the department undertakes financial due diligence processes as part of its procurement for the provision of security services.

“The department’s security contracts include standard provisions that allow contractors to apply for price increases due to variations in labour costs under their nominated award, and other legislated or statutory increases in workers’ compensation, superannuation and payroll tax payments payable with respect to the labour,” he said.

“The department abides by the terms and conditions of its goods and services contracts.”

‘Pure incompetency’

Ben lodged a claim for his missing super with the ATO when the business was still in operation.

The Perth resident describes his experience of trying to chase the money and follow up with the ATO as “terrible”.

“The whole thing is just pure incompetency … and it’s not right,” he told news.com.au.

“If I owed them money I would guarantee they wouldn’t let me breathe.”

Ben is particularly critical as he can’t believe an employer can get away with not paying superannuation.

“It's hard to tackle, it’s very difficult,” he added.

An ATO spokesperson said it takes non-compliance with super guarantee (SG) obligations seriously and have a focused review and audit program into the non-payment of SG to protect workers and their retirement savings.

Employers who do not meet their super obligations risk further action from the ATO, including audits and penalties which can be up to 200 per cent of the liability, they added.

A super big problem

Australians are owed at least $2.2 billion in superannuation that hasn’t been paid by employers, according to the ATO.

Not only do employees miss out on the compound interest they would have earned from the money sitting in their superannuation account, but they are also exposed to other risks such as having death and disability insurance cancelled.

For Ben, his superannuation sits at just $60,000 when he said for his age he should have accumulated a lot more.

“It should be more than $100,000,” he added.

ATO powers in question

Ben is particularly scathing of the ATO’s inability to recover superannuation.

The dad-of-one said in conversations with the ATO, he’s simply been told it’s up to the employer to pay.

“I believe they have got the power, they are just not utilising it – they can’t be bothered,” he said.

“Their only focus is building revenue, that is their main focus, they don’t care if I lose $6000. “They don’t give a s**t as its my money, it’s not theirs. These are the people who are supposed to be there for us. Why can’t I get my $6000 in super? It’s just crazy.”

Ben even approached his local MP for help on the matter, who helped him get a case manager from the ATO appointed to his matter, but said his emails are largely ignored, despite “hounding” them almost weekly.

An ATO spokesperson said it applies a full range of firmer actions including director penalty notices, garnishees, directions to pay, disclosure of business tax debt and prosecution actions to ensure payment on superannuation debts.

“The ATO aims to collect unpaid debt owed by an employer as soon as possible but some employers may not be able to pay in full,” they said.

“There are situations where it can be harder for the ATO recover unpaid superannuation including if an employer is bankrupt, in liquidation, under administration or deregistered.”

The company debts

Gavin Moss and Henry Kwok from insolvency firm Chifley Advisory were appointed as liquidators of the La Fortuna company, which started in May 2017.

It provided security services for the WA Department of Education, TAFE campuses as well as for other ad hoc customers.

Their report, filed with ASIC, revealed that employees; with around 38 full-time, 23 part-time and 50 casual and contracted employees, were owed a total of $3.7 million worth of entitlements.

Meanwhile, outstanding debt to creditors topped more than $2.4 million.

It meant Australian Guards and Patrol had a total debt of more than $6.1 million when it went into liquidation.

Chifley Advisory’s investigation found failure to pay superannuation entitlements and tax liabilities, as well as “insufficient full-time staff to perform ad hoc call-out tasks and require higher costed casual staff to perform the tasks which have limited profit margin” may have contributed to the company’s financial difficulties, a report released in October last year said.

The ATO was the biggest unsecured creditor, with outstanding taxation debts totalling $2.05 million, noted Mr Kwok.

The report also identified payments on the company’s bank statements between March 27 and October 3, 2023, totalling $3 million, which “may constitute potential unreasonable director related transactions”.

This included $580,000 with a description suggesting “payments are made to the ATO, however, there is no record of these funds received by the ATO on the ATO statements”.

Further investigations were required into the transactions, the report added.

*Name changed for privacy reasons

sarah.sharples@news.com.au

More Coverage

Originally published as $3.1m owed to workers of collapsed company La Fortuna