China steel warning hits iron ore miners hit as production and emissions cut

Iron ore prices have dived to their lowest levels in more two months amid fear of waning demand from Chinese steel producers due to steps to curb pollution.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Iron ore prices have dived to their lowest levels in more two months amid fear of waning demand from Chinese steel producers as the world’s biggest consumer takes steps to curb pollution.

Singapore futures fell 8.8 per cent to $US173.80 a tonne and Dalian futures dived 9.4 per cent on Friday after spot iron ore fell to $US194 on Thursday, down 17 per cent from a record high of $US233 a tonne in May.

The abrupt falls pushed Fortescue Metals down 5.3 per cent to $24.91 on Friday, while Rio Tinto closed down 0.6 per cent at $133.42. BHP finished up 0.3 per cent at $53.59.

Analysts said the price of Australia’s biggest export was reacting to expectations of weaker demand caused by Beijing’s policies to reduce China’s steel output as a means to cut emissions.

Beijing raised export tariffs on some steel materials and removed rebates on cold-rolled products this week after China’s steel production rose 12 per cent in the first half of 2021, despite attempts to cap steel output below last year’s record high.

Shagang Group, the world’s fourth largest steel mill, said it would curtail production and overseas sales to comply with government efforts to cut emissions.

China’s deputy minister of housing and urban development, Ni Hong, met with local officials from Yinchuan, Xuzhou, Jinhua, Quanzhou and Huizhou and urged them to strengthen regulation after prices rose too fast in the first half, the People’s Daily reported.

Growth in China’s steel production rose just 1.5 per cent in the year to June, but Beijing’s plan to keep China’s crude steel production flat in 2021 implied that output would need to fall 12 per cent year-on-year in the second half of 2021, according to CBA.

“We don’t expect China’s crude steel output to contract to that extent, but China’s steel production is now facing more headwinds than slowing steel demand,” said CBA mining and energy commodity strategist Vivek Dhar.

Fortescue Metals CEO Elizabeth Gaines said seasonal factors were affecting China’s steel production.

“We’re seeing at the moment some uncertainty obviously with weather events – whether that’s flooding or the typhoon that just recently passed over Shanghai,” she said.

“So there’s a number of different factors that are impacting that overall this year. We would still anticipate that current steel production will still be up year on year.”

Ms Gaines added it was unclear if China was restricting steel production capacity.

“There’s lots of speculation but we’re staying very close to our customers. We’re delivering under our long-term contracts and we’re not seeing any change to behaviour under the terms of those contracts,” she said in an analyst call after Fortescue’s results this week.

Asked in Rio Tinto’s analyst call this week if China’s demand for minerals peaked in the first half of 2021, CEO Jakob Stausholm said that view was “probably right”. “The long-term potential for China is still intact, but we probably have seen non-sustainable high levels of industrial development in some of the months in the first half of this year,” he said.

“What we have seen for decades is a massively impressive industrial development in China. I think it’s fair to say that since the beginning of this year we have seen a particularly big spike.

“You can see China is very capable of managing their economy and they clearly restarted it very well after Covid, but they’re trying to avoid the negative impact of too much expansion.”

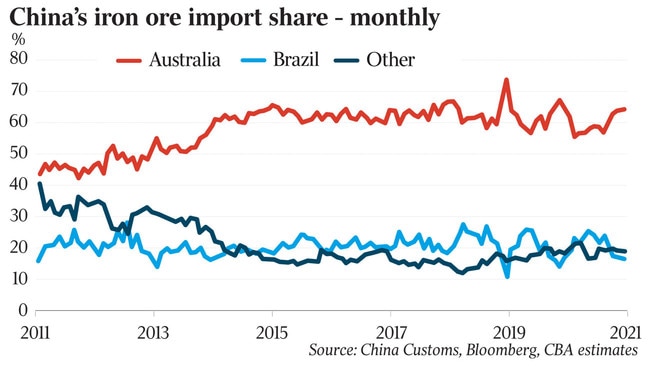

CBA’s Mr Dhar said that while the diplomatic relationship between Australia and China was “still frosty”, concerns were shifting from China restricting or banning iron ore imports from Australia to the “more credible” concern of accelerating measures to reduce dependence on Australian ore.

While it would be very challenging for China to lessen its more than 50 per cent dependency on Australian iron ore in the near term, it could increase iron ore imports from other countries, boost domestic iron ore supply, increase scrap steel usage and reduce steel production.

Mr Dhar said Brazil’s iron ore supply could regain its potential by late 2022, but supply growth after that looked more challenging.

A longer-term option for China was Guinea’s Simandou project, which was at least five years away and likely to initially produce just 60-80 million tonnes per annum or about 4 per cent of the seaborne market, increasing to potentially 150 million tonnes.

Brazil’s Vale, the world’s second-biggest iron ore miner, said this week that it was confident of reaching its annual production target of 315-335 million tonnes despite recent disruption.

“However, we think this supply will likely act as a substitute for high-grade and high-cost domestic concentrate in China, which is likely to keep declining despite efforts to increase local output,” Mr Dhar said.

More Coverage

Originally published as China steel warning hits iron ore miners hit as production and emissions cut