China braces itself for trade war if Donald Trump returns to the White House

The possibility of a US trade war under a second Trump presidency is behind the Chinese Premier’s engagement in Australia, UBS economist Ning Zhang says.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Chinese Premier’s visit to Australia comes as Beijing is seeking friendlier relationships with Western countries in the face of a possible trade war with the US, UBS’s senior China economist Ning Zhang says.

In an interview with The Australian during a visit to Australia, Mr Zhang said China was bracing itself for a trade war with the US that could harm its economy if Donald Trump won the November election.

And China’s concern about a potentially more hostile relationship with a Trump administration was one of the factors behind its strategy of having a more friendly relationship with other countries such as Australia, New Zealand and the European Union, he said.

“The bottom line is that China wants to make more friends,” he said. “Better bilateral trade has benefits for both sides.”

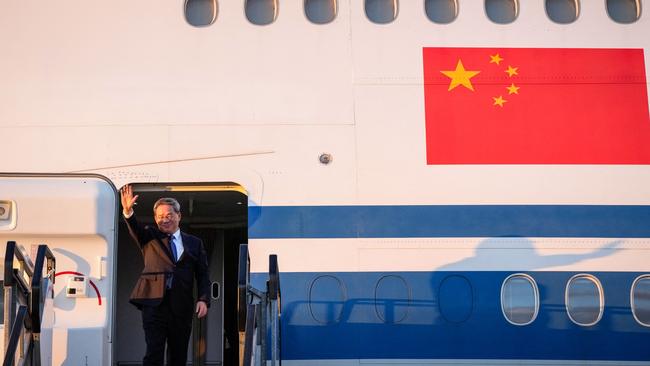

His comments come as China’s Premier, Li Qiang, began a four-day visit to Australia on the weekend, the most senior Chinese leader to visit Australia since his predecessor, Li Keqiang in 2017.

Arriving in Adelaide, Mr Li said China-Australia relations were back on track “after a period of twists and turns, generating tangible benefits to the people of both countries.”

Mr Zhang said China was looking for closer relationships with other countries to help counter the impact of a serious trade war with the US which could cut more than one percentage point off its economic growth.

“Premier Li is visiting Australia this week after his visit to New Zealand,” he said. “They (the Chinese government) are doing some more communication to allow for more mutual benefits.”

Mr Zhang said Donald Trump’s proposed tariffs on goods from China were significantly higher than the measures he took as president and could potentially cause much more harm to the Chinese economy.

Instead of imposing additional tariffs of 25 per cent on $US250bn ($380bn) of Chinese exports to the US as he did last time, Trump is now threatening to impose a tariff of 60 per cent on all imports from China.

Mr Zhang estimated that this could cut Chinese economic growth – which UBS predicts will come in at around 4.9 per cent this year – by more than one percentage point in 2025.

But he said that the real impact of the move could be cushioned by more stimulatory action from the Chinese government and potentially more exports to other countries.

Mr Zhang said the importance of the US as an export market for China had declined in recent years, with exports to the US making up only 15 per cent of total Chinese exports in 2023 compared to 19 to 20 per cent at the start of the Trump administration.

He said it was impossible to predict exactly what would happen under a second Trump administration. “We have no idea what’s going to happen. It’s unprecedented,” he said.

“We are still working through the impact. It will take some time.

“If there is a trade war with the US, the relationship between China and Australia and other trading partners such as Europe will be closer.”

Mr Zhang said the Chinese government could be expected to make some stimulatory measures if Trump began imposing more aggressive tariffs against Chinese exports.

His comments came as both the US under the Biden administration and Europe have been imposing tariffs on Chinese imports.

The European Union last week announced additional tariffs of up to 38 per cent on imports of electric vehicles from China, in addition to the existing 10 per cent duty.

UBS’s predictions that the Chinese economy will grow at around 4.9 per cent in 2024 are only marginally lower than the official target of around 5 per cent for the year.

The figures are slightly lower than China’s economic growth rate of 5.2 per cent last year.

Mr Zhang said the resilient US economy and the global tech up cycle this year had helped hold up Chinese exports and its economic growth rate this year.

“We are not seeing a collapse in China’s economic growth. It is still growing. We are looking at 4.9 per cent this year and 4.6 per cent for 2025,” he said.

“But we are seeing more downside risk with the prospect of trade wars.”

While the Chinese property sector was still weak, Mr Zhang said Chinese policymakers were working their way through the issues with assistance measures for both infrastructure and residential housing.

But he said local governments, which are a key player in Chinese infrastructure spending, were still in a weak financial position.

The Chinese government’s move to help provide financing for major property developer Vanke also showed a change in sentiment, after it had not come in to prevent the collapse of other developers such as Evergrande and Country Garden.

While the outlook for property investment in China was still weak, expected to fall by five to 10 per cent this year, Mr Zhang said this was “slightly less negative” than it was last year.

Meanwhile, the residential property market had been assisted by a suite of policy measures, including purchases of housing stock by local governments and credit support for stalled projects.

On the other side, the outlook for infrastructure spending was slightly less robust.

“Infrastructure used to be quite robust, but our baseline is that there will be a small deceleration in infrastructure investment growth rather than an acceleration,” Mr Zhang said.

“Even though the central government is ramping up its support including by issuing special treasury bonds to support long-term public investment projects, local governments are facing challenges because local land sales revenue is still declining by about 10 per cent and local government financing vehicles are facing financing restrictions.

“The combination of stronger support from the central government but weak local government spending power means there is not much upside for infrastructure growth.”

Mr Zhang said the rise in Chinese sharemarkets from around April this year was evidence of improving sentiment towards China by foreign investors.

He said the increase in buying had been “triggered by a change of sentiment” and that Chinese economic growth was holding up better than many outside observers had expected.

“The Chinese markets are seen as attractive because of their low valuations,” he said. “That is why we are seeing some capital flowing back to China in the past several months.”

But Mr Zhang said China’s economic outlook could change for the worse next year if a new trade war broke out with the US.

“If Trump wins in November there will be a big risk of a trade war occurring next year,” he said.

“It’s going to be quite a bumpy road ahead.”

More Coverage

Originally published as China braces itself for trade war if Donald Trump returns to the White House

Read related topics:Donald Trump