Charter Hall looking to offload $100m tower in Adelaide

Charter Hall is looking to offload a $100m tower in Adelaide, home to blue chip tenants including EY, Colliers and GFG Alliance.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Charter Hall is looking to offload a $100m office tower in the Adelaide CBD.

The sale campaign comes four years after the fund manager picked up the building, on the corner of King William and Waymouth streets, for $82.25m from private equity group Blackstone.

Tenants in the fully-leased building include EY, Colliers, Kain Lawyers, GFG Alliance and financial service start-up Tic:Toc.

Cushman & Wakefield and Colliers, who have been appointed to sell the building, declined to comment.

However industry sources suggest the property could sell for around $100m.

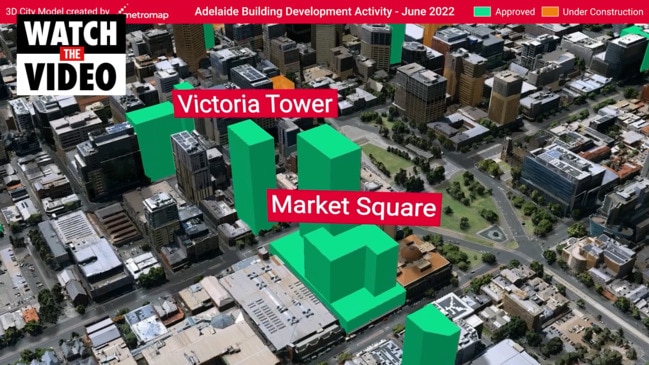

Charter Hall has been one of the most active investors in Adelaide in recent years, and is nearing completion of one of the city’s largest privately funded projects - a $450m office and retail development at 60 King William St.

The company’s managing director David Harrison said the sale of 121 King William St, from the group’s $2.5bn unlisted Direct PFA Fund, was “in line with our strategy”.

“With the imminent completion of the 50,000sq m premium grade office project at 60 King William St, where we have 100 per cent pre-leased the office space to Services Australia, NAB and Telstra, we are looking to recycle 121 King William St,” he said.

The A-grade tower is located in Adelaide’s City Central precinct, which also comprises the ATO building at 26 Franklin St, owned 50-50 by the Charter Hall-managed Direct Office Fund and Long WALE REIT, and the GPO Exchange tower at 10 Franklin St - home to BHP - which is currently held in Charter Hall’s Prime Office Fund following its development in 2019.

The building at 121 King William St rises 15 storeys and comprises of 12,616sq m of net lettable area, with recently upgraded end-of-trip facilities.

Private investors and syndicators have acquired a string of office towers in Adelaide in recent months, attracted by South Australia’s stamp duty exemption on commercial property, and the state’s relatively strong economic recovery from Covid-19 when compared to the eastern states.

Local syndicator Harmony Property Investments paid $130.5m for the GHD Building at Victoria Square in February, representing the largest office deal in Adelaide since 2021, while Shane Quinn’s Quintessential Equity picked up Telstra House on Pirie St for $73m.

Sydney’s Realside Property and Pep Rocca’s Curated Capital recently partnered in the $76m acquisition of a nearby tower at 45 Pirie St.

The investor interest comes despite a recent rise in Adelaide’s CBD office vacancy rate, which reached 16.1 per cent in January – its highest level since July 2017.

That figure’s expected to rise by the end of 2023 as new developments including Charter Hall’s 60 King William St project and Walker Corporation’s Festival Plaza tower are completed.

Expressions of interest in 121 King William St close on May 25.