CBA’s profit lift shows we have finally reached a turning point

The banking giant is the closest thing Australia has to a real-time measure of the economy. And big investors are now betting on an important shift coming.

Commonwealth Bank’s massive size means it is the closest thing to a real-time barometer of the economy. And if the banking major’s latest accounts are anything to go by, they are sending a much better message about the financial health of the nation. After a tough year, Australia may have finally turned the corner.

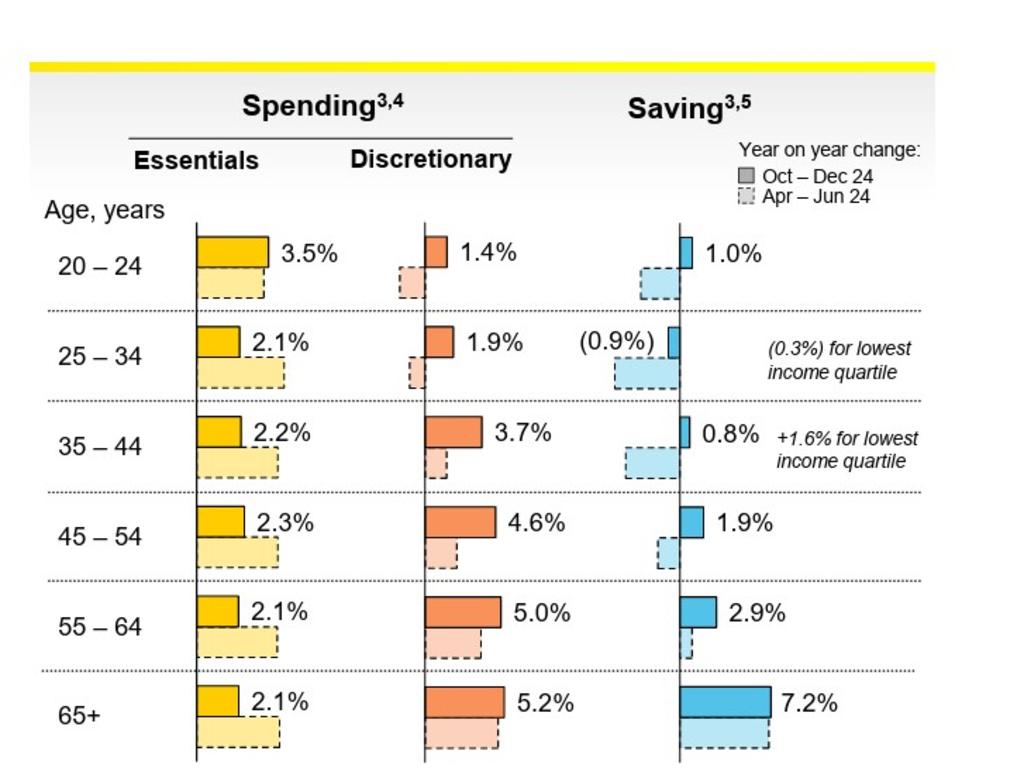

Chief executive Matt Comyn sits at the top of this vast financial machine that counts more than one-in-three Australians as a customer, as well as one-in-four businesses. He says Australians across all age groups are spending more on non-essential items – and importantly – saving again.

However, this shouldn’t overshadow the fact that many people, particularly young families, are still feeling stretched.

There are several strands beginning to come together for households, Comyn says. Last year’s stage three tax cuts; energy rebates also flowing to households; and a slowing pace of inflation, are combining to deliver more disposable cash into the suburbs. This means spending is now more evenly distributed.

“You can see that play through as far as the proportion of spend that’s having to go against essentials has reducing slightly and a slight increase in discretionary (spending) and a slight improvement in savings,” Comyn tells The Australian.

Critically, the bank’s latest December half accounts show customers aged between 20 and 34 which had slashed discretionary spending in the past year, are now starting to spend again. At the same time, the age bracket that had been eating into their savings are also rebuilding their financial buffers.

Others aged between 35 and 54 are also now moving to net savers while sharply boosting discretionary spend. Cashed-up older Australians who have generally had low borrowings continue to be big spenders.

There are other signs that bode well for the economy.

“When we think about this sort of six-month period, relative to perhaps what we would have expected, lending growth has been stronger. We’ve seen a further increase than we would have expected in savings”.

We’ve seen a reduction in financial assistance which we wouldn’t have anticipated would be down 15 per cent, and we continue to see very low levels of loan losses during the (December) period as well,” Comyn says. Other signs include a lift in consumer finance, higher offset loan balances, and ongoing strength in lending to business.

These are very early green shoots “but that’s not understate what we see clearly that households continue to be under a lot of pressure with prices now higher than they were four years ago,” the CBA boss says.

The fact that the conversation on interest rates is now around the timing of cuts, rather than hikes, represents a big confidence shift for households. This has been reinforced by signs the pace of inflation is cooling.

The Reserve Bank meets next week and is widely expected it deliver its first cut since its hiking cycle started. Markets are tipping at least another two cash rate cuts for the rest of the year, taking rates 75 basis points lower.

If this pans out, it will provide much more relief for households particularly at the vulnerable end, which in turn will flow through to the economy.

The big difference through this downturn compared to others is unemployment has stayed near record lows, which delivering a big cushion under what could have been a hard landing.

There’s still risks ahead. Victoria, the second-biggest state economy, is a major laggard in the recovery and is well over-represented in lending losses.

The housing market remains worryingly subdued across the country, especially with much-needed new construction stalled. Inflation is not entirely under control. External threats like Donald Trump’s global trade war could deliver an unexpected shock to business.

Despite these risks, CBA is seeing a lift in its own performance.

Closely-watched cash profit came in at $5.1bn for the December half. This was up 2.3 per cent, marking its first six-monthly growth spurt in a year. This was helped by the drop-off in lending losses.

The bank’s slightly-better-than expected numbers and 5 per cent dividend hike were enough to support its lofty share valuation, pushing it to a new record high of nearly $166. But investors are really betting on the green economic shoots. After all, when Australia does well, so does CBA.

Originally published as CBA’s profit lift shows we have finally reached a turning point