Call to change foreign investment laws to fund resources as big four banks go green

Fossil-fuel aversion in Australia’s banks may encourage changes in foreign investment laws to help the resources sector obtain funding, a parliamentary committee has heard.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A top government official says Australia’s foreign investment laws may have to be altered to allow the resources and fossil fuels industry to access funding as local banks turn off the tap for projects with climate risk.

The Department of Industry, Science, Energy and Resources’s head of resources Paul Trotman told a parliamentary committee on Friday that mining and resources companies were increasingly relying on private equity and international capital to fund more than 300 projects across Australia as local banks turned them away.

“Without support from domestic institutions, businesses will increasingly have to secure investment from overseas providers, from private equity and end-user business or government,” Mr Trotman told the House of Representatives joint standing committee on trade and investment growth.

“An inability for a company to assess or access finance or insurance on competitive terms could have significant impacts on its business outcomes.”

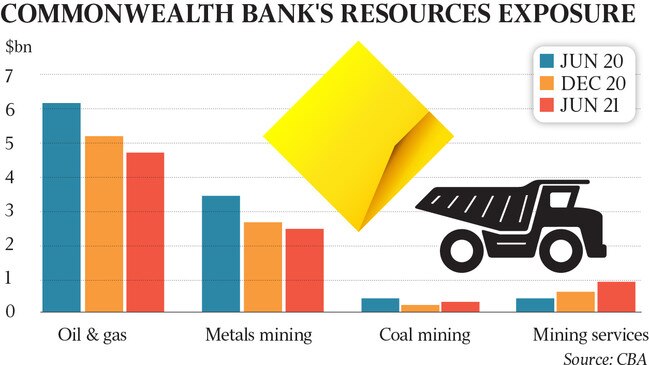

The big four banks have stated their intentions to restrict finance to coal production.

ANZ and Commonwealth Bank plan to exit direct financing of coal plants and thermal coal by 2030, National Australia Bank wants to exit thermal coal funding by 2035 and Westpac will stop lending to companies that derive 25 per cent of their revenue from thermal coal by 2030.

But shareholder pressure means their commitment to sustainable lending is likely to increase.

Shareholder activist group Market Forces lodged a resolution at CBA’s annual general meeting requesting disclosure of how it will manage its exposure to fossil fuels in accordance with a global net zero emissions by 2050 scenario.

The resolution also requested a ban on financing new fossil fuel projects and targets to reduce fossil fuel exposure consistent with net zero by 2050.

Market Forces said CBA’s latest disclosures set “glide paths” for aligned fossil fuel sectors which would see net zero by 2070 – not 2050 – while accusing the bank of watering down its commitment to only fund new resource projects consistent with net zero.

Also on Friday, Australian Prudential Regulatory Authority chair Wayne Byres told the parliamentary committee the regulator was working with the banks on a climate vulnerability assessment.

“This work is designed to measure the potential financial risks to the banks, the financial system and economy posed by climate risks, understand how the banks may adjust their business models and implement management actions in response to the different climate scenarios, and to improve the climate risk management capabilities of the banks,” Mr Byres said.

Mr Trotman said that although international financiers could help close some domestic funding gaps, they would often lend at a higher cost or not at all without the benefit of a local partner to provide due diligence.

“It is often the case that international financiers will only support a project if it has been locally supported, and that is to say that Australian banks are a key part of the funding mix,” he said.

“And as noted by Centennial coal, Whitehaven and Yancoal in their submissions to the inquiry, in addition to the direct impacts of restricted access to local capital, domestic bank policies raise the cost from financing from international investors.”

One solution, Mr Trotman said, could be to revisit the barriers for direct foreign investment in projects set by the Foreign Investment Review Board. “In this environment, Australia’s foreign investment law settings will be important to ensure that foreign investors, where appropriate, are able to invest in Australian resources projects,” he said.

Mr Trotman said resource companies were finding it harder to insure their projects, and the department was watching with interest media reports of a plan by the coal industry to set up a self-insurance scheme.

Committee member Rowan Ramsey asked Mr Trotman if the government was planning to help finance the resources sector.

“The difficulties in terms of what a lot of companies are facing are not necessarily homogeneous. It changes from company to company and there are various commercial decisions depending on access to finance,” Mr Trotman replied.

“In terms of me providing a commitment to the committee today that the government is actively considering providing assistance, I cannot do it. it will be a decision for government.”

Originally published as Call to change foreign investment laws to fund resources as big four banks go green