Australian sharemarket tanks, Vic lockdown hits travel stocks

The ASX was already on its way down when Victoria’s latest lockdown was announced and kept sliding as the session dragged on.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian sharemarket tanked after Victoria announced another lockdown over fears around the growing COVID-19 cluster, hitting travel stocks.

The S&P/ASX200 finished 0.63 per cent lower at 6806.7 while the All Ordinaries Index fell 0.57 per cent to 7081.3.

National carrier Qantas suffered its worst one day performance since June 29, sinking 4.81 per cent to $4.55 while Webjet had its worst day this year so far, dropping 3.93 per cent to $4.64.

Flight Centre gave up 2.68 per cent to $14.14, Corporate Travel Management lost 2.5 per cent to $17.54 and Regional Express backtracked 1.36 per cent to $1.81.

Gold miners were among the poor performers after the precious metal’s price decreased, with Westgold plunging 7.4 per cent to $2 and Perseus Mining sliding 5.2 per cent to $1.18 while Australia biggest gold miner Newcrest eased 0.99 per cent to $25.96.

Rio Tinto softened 1.15 per cent to $117.35 and BHP erased 1.67 per cent to $44.72 but Fortescue lifted 0.59 per cent to $23.83.

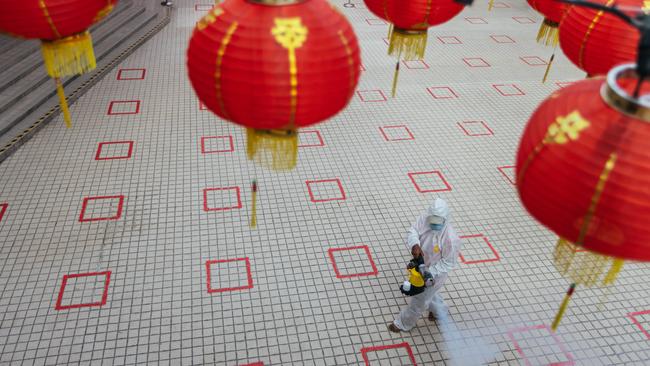

“Keep in mind we’re not getting any sort of lead from iron ore prices at this stage, for most of next week as well, and that’s due to the Lunar New Year holidays, which keeps the Chinese sharemarket closed,” CommSec markets analyst Steve Daghlian said.

OpenMarkets Group chief executive Ivan Tchourilov said trading volumes were expected to be lighter during the holiday and the direction of the Australian market would likely be dictated by another big week of domestic earnings reports.

“Reporting season has thus far claimed a few scalps with AMP and Cimic Group both feeling the pinch while Commonwealth Bank and Telstra both gave investors something to cheer for, announcing increased and maintained dividends respectively,” Mr Tchourilov said.

AMP again lost ground after announcing on Thursday its would-be takeover suitor had decided against a full bid for the wealth management group, declining 3.65 per cent to $1.32.

Construction firm CIMIC retreated 1.44 per cent to $20.55 despite reporting a big contract win.

After rising following the release of its half year report on Wednesday, Commonwealth Bank inched 0.21 per cent lower to $86.87.

National Australia Bank retreated 0.48 per cent to $24.93, Westpac shed 0.67 per cent to $22.14 and ANZ slid 0.28 per cent to $24.82.

Property developer Mirvac reported a slump in first-half statutory profit to $396 million, from $613 million for the previous corresponding period.

The company noted government housing stimulus measures had boosted demand but said its urban shopping centres continued to operate in a challenging environment.

Mirvac shares retreated 1.7 per cent to $2.32.

Crown Resorts dipped 1.59 per cent to $9.89 after announcing former AFL boss Andrew Demetriou was stepping down as a director in the wake of the damning NSW ILGA inquiry findings, but chief executive Ken Barton is clinging on while he and the casino operator “consider his position”.

In the tech space, Zip Co was a standout this week, putting on close to 20 per cent and reaching a new all-time high, Mr Tchourilov said.

“It’s amazing how much momentum the BNPL space still has,” he said. “Investors are still very much willing to pay up from a valuation perspective to get exposure.”

Zip appreciated 0.46 per cent to $10.83 while larger rival Afterpay went in the other direction, subtracting 1.98 per cent to $151.74.

The Aussie dollar was fetching 77.47 US cents, 56.13 British pence and 63.86 Euro cents in afternoon trade.

Originally published as Australian sharemarket tanks, Vic lockdown hits travel stocks