Bombshell $85 billion offer for Time Warner ‘hard to resist’

TIME Warner’s New York billionaire shareholders have declared it’s “tough to say no” to Rupert Murdoch’s bombshell $85 billion bid to merge his 21st Century Fox with its media empire.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

TIME Warner’s New York billionaire shareholders have declared it’s “tough to say no” to Rupert Murdoch’s bombshell $85 billion bid to merge his 21st Century Fox with its global entertainment and media empire.

The audacious bid to create the world’s biggest media and entertainment company, with a market value of $160 billion, would be the biggest play of the 83-year-old’s lifetime of deal making.

As shares in Time Warner soared 17 per cent to a few dollars shy of Mr Murdoch’s offer price, billionaire fund managers who own shares in Time Warner said the board would find it tough to resist, particularly if Mr Murdoch comes back with a higher offer.

Ken Griffin, chief executive of hedge fund firm Citadel, said the deal made sense for the company’s shareholders.

TERRY McCRANN: MURDOCH AS AUDACIOUS AS EVER IN MEDIA BID

MURDOCH’S PLAN FOR MEDIA JUGGERNAUT

And Mario Gabelli, chief executive of Gamco Investors, called it “hard for a board to turn down.”

“It’s going to get tough to say no,” Mr Griffin said at a conference in New York overnight on Thursday.

“Murdoch has a history of being willing to go the extra mile to get deals done that are important to him.”

Mr Griffin’s $20 billion investment firm held stakes in both 21st Century Fox and Time Warner as of March 31.

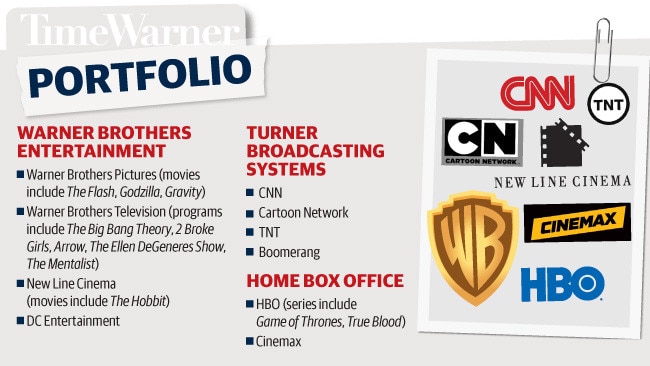

The takeover bid is not expected to end with Time Warner’s knock-back on July 3, but for now it is keeping a firm hold on its prized assets, including CNN, Warner Bros films and HBO.

Time Warner’s board rejected the offer of $85 a share, despite the $US25 billion mark-up on its company value, saying in a statement that its own strategic plan would deliver more value.

Analysts speculated this would be the opening salvo in what could be months of negotiations as Time Warner declared its strategy “superior to any proposal that 21st Century Fox is in a position to offer”.

But Time Warner is understood to be seeking another $US30 billion.

In a statement on Thursday 21st Century Fox confirmed the offer and the knock back.

“We are not currently in any discussions with Time Warner,” the statement said.

Time Warner shares in New York soared 17 per cent to $83.13, the biggest gain in 14 years, after news of the deal broke on Wednesday night local time.

Shares in 21st Century Fox lost ground, closing 4.64 per cent down at $32.57.

If Mr Murdoch’s “mega bid” gets over the line, Australian viewers are expected to share in the spoils, analysts say.

The offer revealed how much value 21st Century Fox is placing on content.

Unless a rival bid emerges, potentially from a Silicon Valley heavyweight such as Google, Mr Murdoch is looking at a much greater arsenal of content choices - from US college basketball to HBO’s Game of Thrones and Warner Brothers movies - to attract and retain viewers.

How that content reaches Australian viewers could change significantly.

Already companies such as Netflix, Google and Apple have invested heavily in subscriber-based versions of TV stations, while for Fox, apps modelled on Time Warner’s successful HBO Go could be introduced here.

Originally published as Bombshell $85 billion offer for Time Warner ‘hard to resist’