BHP shoots down Fortescue’s scaremongering over the Pilbara’s future

BHP says Chinese blast furnaces have a long way to run, and unveiled a big breakthrough with Baowu. If BHP is right, the Pilbara golden goose will be just fine, countering Andrew Forrest’s claim the region risks becoming a wasteland.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

BHP has served up a reality check on green iron, saying the biggest reduction in carbon emissions from steelmaking over the next two decades will not come from reinventing iron ore mining, but advances in China’s blast furnaces.

It expects those blast furnaces to run for at least 20 to 30 years, and disputes there is any scenario where West Australia’s iron ore exports are usurped by competing green technologies.

The mining giant describes massive hurdles to Australia becoming home to a commercial green iron industry, even with the Albanese government touting a $1bn green iron fund in February.

BHP’s view of the world was informed by working with the world’s biggest steelmaker, China’s Baowu, to achieve a breakthrough in the technology: they used iron ore from the Pilbara in emissions-reducing direct reduced iron (DRI) production at commercial scale in a plant in mainland China.

The trial at Baowu’s Baosteel Zhanjiang Iron & Steel Company was published in Mandarin on WeChat.

The work being done in China suggests that any future large-scale green iron plants will sit close to existing big steelmaking customers, rather than in WA, despite calls for billions of dollars of taxpayer support to develop the nascent industry.

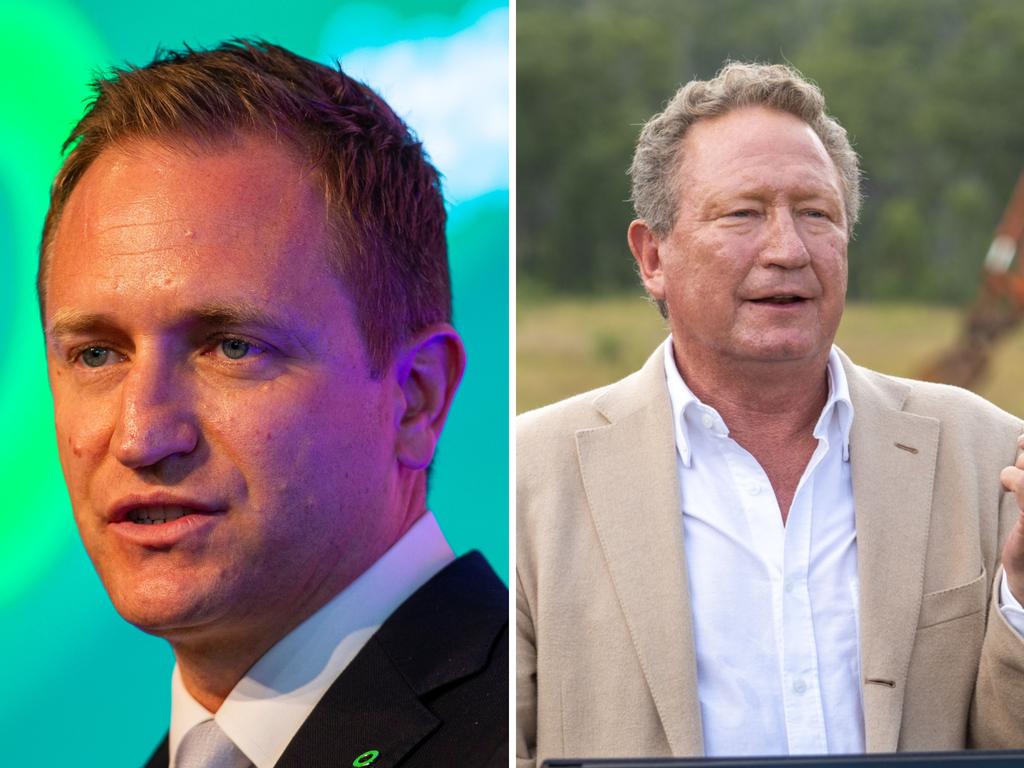

Fortescue founder Andrew Forrest has warned the Pilbara, where his company makes all of its money, could become a wasteland without an urgent, government-backed leap into green iron.

And a think tank founded by Ross Garnaut and Rod Sims wants the Albanese government to offer major subsidies to iron ore giants and global steelmakers to attract green iron investment to Australia.

The Superpower Institute, which also includes Climate 200’s Simon Holmes à Court on its board, is pushing for production tax credits of $170 a tonne, plus grants covering 30 per cent of investment costs as well as other taxpayer support to make Australia a green iron force.

It says the prize is an estimated $400bn annual export opportunity.

Forrest’s Pilbara warning

The push for taxpayer support sets up another round of the “billions for billionaires” debate triggered by the Coalition in response to Labor’s support for green hydrogen and critical minerals processing under its flagship Future Made in Australia policy.

Dr Forrest’s argument suggests China’s vast network of blast furnaces is endangered.

“They are going to shut down the old-fashioned, two-century-old technology of burning sticks and logs, putting in coal, putting in iron ore, burning it all and sending up masses of pollution into the atmosphere and producing steel,” he said in Perth last week.

In 2023, he warned humanity was at risk from lethal humidity.

“They’re looking straight into a future that may or may not include WA,” the Fortescue billionaire said.

BHP’s vice-president for sales and marketing sustainability, Ben Ellis, joined Rio Tinto iron ore boss Simon Trott in rejecting Dr Forrest’s claim about the Pilbara becoming a wasteland.

Australia is the world’s largest producer of iron ore with most of it coming from the Pilbara underpinning $100 billion in export income in 2023-24.

“Under any scenario we look at, there’s really going to be strong demand for Pilbara ore under any of the viable green steel pathways,” Dr Ellis said.

BHP is working with partners and its customers on pathways to cutting emissions, including modifying existing blast furnaces, and proving DRI can be produced in electric smelting furnaces (ESFs) at commercial scale.

China and other big steelmaking nations plus BHP, Rio and Fortescue are unified by one thing: they want the ESF technology to work.

DRI production in electric arc furnaces is proven, but only suitable for high-grade iron ore that makes up about 5 per cent of world supply.

While Chinese steelmakers like Baowu are working on ESFs, their immediate focus is cutting emissions from blast furnaces through the injection of hydrogen and carbon capture and sequestration.

Decarbonising blast furnaces

“We need ESF to work and unlock that. But we can’t forget the incumbent technology, the blast furnace. There’s more than a billion tonnes of production in China from the blast furnace,” Dr Ellis said.

“There’s a pathway for that technology to be decarbonised … to about 80 per cent lower emissions. And when you actually go and talk to our customers, they’re not just focused on ESF. They’re also focused on how can they decarbonise with the blast furnace today … China and up and coming India have all this blast furnace installed capacity, and those furnaces are going to run for two or three more decades.”

Dr Ellis said BHP in partnership with Rio and BlueScope, and with support from Woodside, was on track to start building a pilot ESF green iron plant at Kwinana, south of Perth, in the second half of 2026 and with commissioning in 2028.

The consortium’s NeoSmelt project has received a $75m leg-up from the WA government. The partners have flagged spending several hundred million dollars building a plant capable of producing 40,000 tonnes of molten iron a year at a site next door to BHP’s mothballed nickel refinery.

“We realise that the problem is bigger than any of us can solve individually. It’s just about pulling our resources, and working on this problem together in the nation’s interest and that’s aligned with our own interests,” Dr Ellis said.

Pilbara grades problem

BlueScope warned from the start of the project that the low and medium grade iron ore being produced in the Pilbara did not work well in the novel emissions reduction technology. The company’s North Star steelworks in rural Ohio relies completely on shredded cars and other scrap to make high quality steel.

The NeoSmelt partners hope reductions of up to 80 per cent in emissions intensity can be achieved in processing Pilbara iron ore through a DRI-ESF combination.

Dr Ellis said the site Kwinana was probably big enough to build a commercial scale plant capable of producing 1-2 million tonnes a year but that had not been discussed by the partners.

He said there were numerous hurdles to overcome in building a commercial-scale plant but a big advantage in having a pilot plant in WA.

“We can bring our customers to have a look at the iron ore mines and we can show them this technology. We can share the technical learnings with them, and they can take that away and think about implementing that in their own decarbonisation plans,” he said.

Dr Ellis said there was an opportunity to decouple iron making and steel making.

He said iron making in Australia would be very challenging based on BHP’s experience with producing hot briquetted iron, and that the availability and price of green energy was just one of the hurdles.

“You need to have the right technical expertise, you need to have the right infrastructure to support that, and ultimately we believe that’s probably best done closer to the demand centres,” Dr Ellis said.

The furnaces burn at 1500C, operate at high pressure and need hydrogen or natural gas for fuel.

Who can make green iron?

The Superpower Institute identified the Pilbara, Geraldton, and Kwinana in WA as the best locations for production, along with the Eyre Peninsula in South Australia and Gladstone in Queensland.

Mr Sims, a former chair of the Australian Competition and Consumer Commission, questioned whether the big iron ore miners were cut out to produce green iron.

“This isn’t the natural forte of an iron ore miner, it’s the natural forte of an international iron and steel company,” he said.

The price tag of building a local green iron plant capable of producing a million tonnes a year is estimated at $7bn including the renewable energy component.

In launching the government’s billion-dollar green iron fund – that includes up to $500m to support a transformation of the Whyalla steelworks – Mr Albanese claimed Australia had the resources, the workers, and the know-how to make green iron.

“The only thing we don’t have is time to waste,” he said.

BHP is working with 11 steelmakers – representing about 22 per cent of the world’s production – on multiple projects aimed at cutting greenhouse gas emissions by 30 per cent relative to conventional blast furnace steelmaking by 2030.

WeChat science

The successful trials by Baowu involved a million-tonne-a-year hydrogen-based DRI shaft furnace, which is the first of its size in China.

BHP iron ore fines at different blending ratios were pelletised before being converted to DRI in the shaft furnace with 70 per cent hydrogen in the reducing gas. The resulting DRI was mostly consumed in a commercial scale basic oxygen furnace at the same site, displacing hot metal and scrap. The DRI produced had an estimated 50 per cent lower carbon intensity than the blast furnace hot metal.

More Coverage

Originally published as BHP shoots down Fortescue’s scaremongering over the Pilbara’s future