Beston Global Food Company will be shut down after failing to attract a buyer

About 150 jobs will go at South Australian dairy outfit Beston Global Food Company after the collapsed business failed to attract a buyer to resurrect it out of administration.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Beston Global Food Company will be closed down for good in early December – with the loss of about 150 jobs – after the collapsed dairy company failed to find a white knight to buy it out of administration.

SA Dairyfarmers’ Association chairman Robert Brokenshire said about 40 farmers were owed more than $10m for milk previously delivered, which they were now unlikely to see.

Beston was placed in the hands of administrators KPMG in September after racking up years of losses and $72.1m in debt, with $52.5m of that owed to NAB.

Unsecured creditors are owed another $16.7m, a report to creditors shows, with 307 creditors in total, including employees.

Beston bought about 160 million litres worth of milk, worth about $120m, from farmers last year. Mr Brokenshire said much of that milk had found a home with other processors, and the SDA was confident that eventually all of the milk would find a buyer.

“We believe we’ve got a home for most of that if not all of that,’’ he said. “The positive is we do have some other processors that are expanding here at the moment and are able to take up some more milk.’’

Mr Brokenshire said the long-term outlook for the dairy sector was “pretty strong’’, so it was crucial to ensure milk production was not curtailed by issues such as the failure of Beston.

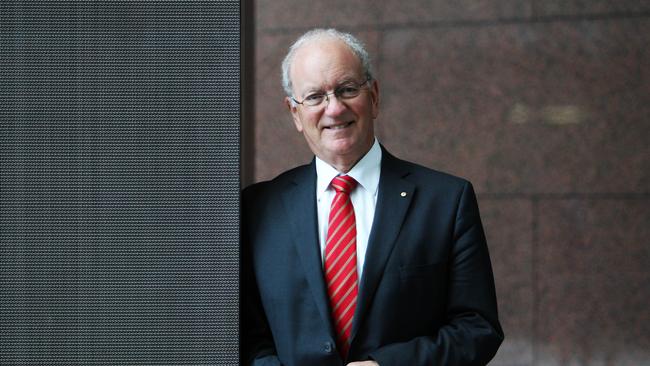

Beston, which was chaired by founder Roger Sexton, listed on the Australian Securities Exchange in 2015, valued at $130m, but never turned a profit despite growing revenues strongly in recent years. The company delivered record revenue of $169.6m last financial year, and a record loss of $48.9m.

KPMG said on Tuesday that operations would cease on December 6.

“The administrators will continue to trade the operations on a ‘business as usual’ basis until completion of the current production cycle, which is expected to occur within the next two weeks,’’ KPMG said.

“Due to significant trading losses being incurred on a weekly basis, the administrators were not able to fund the business beyond 30 November 2024.

“Therefore, the administrators have been left with no alternative but to wind down the business and begin an orderly sale of its assets.’’

It is understood farmers will be paid in full for the milk delivered while KPMG was running the company in administration.

KPMG started a process to sell the business as a going concern on September 26, with several parties expressing interest.

The professional services firm said in October that it was approached by 30 unsolicited parties and made direct contact with a further 12 in the dairy industry.

Of these, 22 signed non-disclosure agreements and site visits were to be conducted, but none of the approaches ended in a deal.

“While the administrators provided certain parties with additional time to finalise the terms of their respective offers, these parties have been unable to put forward a binding offer for a going concern sale.

“Ultimately, the sales process has failed to secure a buyer in the time frame required, given the trading losses being incurred.’’

Beston tried to sell part of the business to Japanese company Megmilk Snowbrands before going into administration, but that deal fell through also.

Beston started out as a diversified agricultural investment vehicle, which on listing owned assets or stakes in several agricultural outfits in sectors including rock lobsters, meat and water.

It pared these back over the years to focus on producing cheese products as well as lactoferrin, but failed to operate profitably.

Beston conducted a major capital raising in late 2022, raising $28.2m at 2.5c a share – understood to be at the behest of its major lender, NAB – with $16m of that used to pay down its debt burden from $48m to $32m.

The company’s debt continued to spiral.

Beston’s board, led by Dr Sexton, also racked up a number of protest votes against its remuneration reports over the years.

Former Santos chair Stephen Gerlach was also a founding director of the company.

Originally published as Beston Global Food Company will be shut down after failing to attract a buyer