Battleground among banks emerging, involving perks, cash back

Banks are ramping up efforts to lure and retain transaction account customers, as competitive intensity shifts in a big way to the deposit and everyday banking market.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Banks are stepping up their efforts to lure and retain transaction account customers, as competitive intensity shifts in a big way to the deposit and everyday banking market.

It reflects a fiercer competitive tussle for transaction banking customers, as focus appears to have moved from home loans to another section of the retail banking market.

There are interesting dynamics playing out this year as banks and their retail customers await Reserve Bank interest rate cuts, which typically weigh on bank profitability through net interest margins.

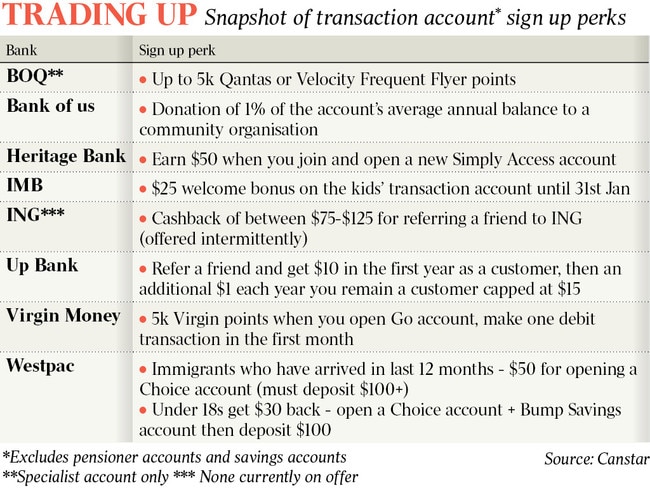

Analysis by Canstar – conducted on behalf of this column – shows banks are offering sign-on and referral cash, ongoing discounts, rebates, reward points and even donations to transaction account customers.

Canstar’s analysis shows Heritage Bank, for example, is offering new customers $50 when they sign up and open a Simply Access account. Westpac is giving immigrants who have arrived in the past year $50 for opening a Choice account and depositing $100 or more, while Bank of Queensland-owned Virgin Money gives new customers 5000 Virgin points when they open a Go account and make a debit transaction in the first month.

Tasmania’s Bank of Us, a customer-owned institution, pledges to donate 1 per cent of the account’s average annual balance to a chosen community organisation.

Cash-back offers in the mortgage market were a huge feature during the so-called mortgage wars, but among the big four banks only ANZ is still offering cash backs on home loans.

ANZ offers $2000 to those refinancing their mortgage to the bank, while first-home buyers can receive $3000 in cash back. But most major lenders have retreated from offering cash back on mortgages, after complaining that competition for home loans was seeing them written below the banks’ cost of capital.

Some of those competitive dynamics are now evident in the transaction account and deposit market.

However, Australia appears to be a fair way behind the US in terms of attractive sign-up cash for transaction banking accounts. A search by this columnist found at least two banks in the US offering $US300 ($475) to customers signing up to transaction accounts, if various terms and conditions were met.

Even so, there is in Australia a notable increase in the number of banks offering ongoing perks on transaction accounts compared to 2020. These perks are a clear attempt to woo new customers and retain and deepen relationships with existing ones.

“This is fast becoming the new battleground and much of this effort is targeted at younger adults who regularly bank using an app on their phone,” Canstar data insights director Sally Tindall says.

Canstar’s analysis showed ANZ is offering $12 movie vouchers at Hoyts and priority or pre-sale tickets to certain events, while Westpac customers get bonus cash back with the ShopBack app. Commonwealth Bank customers who make more than five purchases a month get access to its Yello program including retailer discounts, cash back and other offers, while at National Australia Bank discounts and cash back are available at specific retailers for those meeting spend requirements.

Part of this push reflects that earnings growth prospects for the domestic banks are limited, meaning they are all assessing how to do more with the customers they have. About two decades ago, a similar push was referred to as product cross-selling as banks looked to get more products in the hands of existing customers.

Banks steer clear of those terms nowadays, but essentially if they can win and retain a customer’s main transaction account there is scope to then offer them additional products including personal loans and a mortgage.

Of course, more engagement with customers also provides banks with even more data, which can provide useful insights and marketing assistance around which banking products may be relevant to that person. More engagement is also likely to equate to stickier customers.

When CBA expanded Yello in late 2023, it estimated the customer recognition program would see the bank provide about $400m of value to customers each year.

CBA chief executive Matt Comyn has said in creating new customer experiences the bank was aiming to be “the trusted centre of our customers’ financial lives”.

Ongoing perks at other banks, according to Canstar, include Macquarie Bank offering discounts on shopping gift cards of up to 12.5 per cent at some retailers. HSBC provides for 2 per cent cash back on petrol, groceries, or takeaway up to $50 a month, if customers deposit more than $2000 a month, while ING customers can receive 1 per cent cash back on gas, electricity and water bills of up to $100 each financial year if they deposit more than $1000 a month and make more than five purchases.

ING also frequently runs offers that give existing customers and their friends cash related to a customer making a referral and the friend joining the bank. While none of those are running now, they have ranged from payments of $75 to $125.

Up – owned by Bendigo and Adelaide Bank – gives customers $10 if they refer a friend in their first year as a customer, then $1 for each year they remain with the bank. The additional annual amount is capped at $15.

In 2023, when ANZ Plus was ramping up, there were periods when the bank was offering customers $50 to refer a friend to the new platform, while the person joining would also receive $50 if various criteria were met.

Such offers are certainly not without strings attached, and those seeking to make a quick buck are advised to read the fine print. What they are evidence of is the lengths banks will go to secure new customers against the backdrop of a constrained growth environment.

Globally, account sign-up offers and perks appear to be proliferating.

In the United Kingdom, Barclays has three transaction account options, including a no-frills, zero monthly fee option with no perks. The second option which has a £5 ($10) monthly fee comes with perks including an Apple TV+ subscription the bank says usually costs £8.99 a month, and a major league soccer season pass subscription worth £14.99 a month.

Barclays’ third option is a top-tier account that requires customers pay in a gross annual income of at least £75,000, or have a total balance of at least £100,000, which can be savings or investments with the bank.

In the US, where Barclays wants to attract new customers, the bank is offering a $US200 bonus when those signing up deposit $US25,000 ($39,600).

At US banking giant Wells Fargo, the eligibility for new customers to receive $US300 is much lower. The bank is offering that to customers if they open an account by mid-April and deposit an initial $US25. They are then required to put $US1000 or more in “qualifying direct deposits” into the account within 90 days of opening it.

At Bank of America, if customers open an account this month they can receive $US300 if they set up and receive “qualifying direct deposits” of $US2000 or more. That needs to happen within 90 days.

While Australia has a much smaller and concentrated banking market, it will be interesting to see how these trends evolve in coming months and years.

Token watch

The use of tokens in asset management is getting traction, perhaps aided by investment behemoth BlackRock last year unveiling its first tokenised fund, issued on a public blockchain.

Closer to home, liquidity solutions group Liquidise and digital asset management firm JellyC have forged an agreement to tokenise the latter’s funds.

That means in theory investors will be able to trade the funds more readily and directly via the tokens, boosting fund liquidity.

The tokenisation will occur via the Redbelly Network – developed at the University of Sydney with the CSIRO – and users are subject to know-your-client processes and other compliance criteria.

The partnership may mark the first Australian fund manager to forge down this path, although others are actively assessing it.

Boston Consulting Group research notes that. having amassed more than $US2bn in assets under management as of late last year, tokenised fund assets could reach 1 per cent of global mutual funds’ and exchange-traded funds’ assets.

The report said that would imply assets under management of more than $US600bn by 2030.

Michael Prendiville, co-founder of JellyC, says: “Collectively we will be paving the way for the mainstream adoption of tokenised funds.”

Originally published as Battleground among banks emerging, involving perks, cash back