Aussie loses $20k in ‘horrible’ way

A Melbourne man, who is paying off crucial bills with money from the sale of his house, has been struck by a “horrible” issue.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

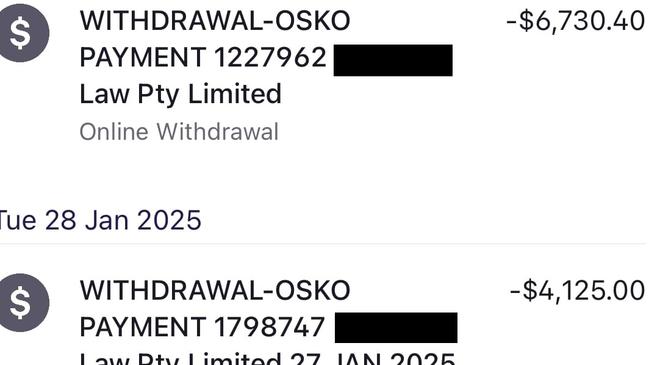

When an Aussie dad uncovered that he had lost $20,000 after making four simple transfers, he was left feeling “horrible”.

The money was to pay for legal fees and Brett D’Souza said he only uncovered the disaster the transfers had unleashed two weeks after it happened.

“It is a lot of money with all the legal fees,” he told news.com.au.

“I sold my house last year and that is where the money came from and I’m renting now.”

Little did the 48-year-old know that he had fallen victim to an email interception scam.

He believed his law firm had sent through an invoice but with new account details.

The Melbourne man even questioned the law firm about the change of account details over email but was reassured they were correct – yet he had no idea that scammers had infiltrated.

MORE: How to avoid real estate scams

Once he discovered the fraud, he immediately contacted his bank Westpac but it was too late to recover his money.

However, he has been left furious that the bank account where the stolen funds were deposited was allowed to be opened or used as a money mule account at ANZ.

“I understand why Westpac isn’t liable as it wasn’t just taken out of my account as I approved it,” he said.

“The bit I have a problem with is the other end with ANZ. The bank allowed someone to create a bank account with (potentially) this business name.”

The filmmaker said he was left in the “horrible” situation and questioned whether security measures are strong enough when it comes to opening bank accounts in Australia.

“Surely ANZ should be liable for allowing the fake account to be created,” he said

“I just think there needs to be some accountability. What was process with that individual to make that account with ANZ? Can they do it online and put any name they want?”

An ANZ spokesperson said the bank does not comment on individual customers.

Mr D’Souza now plans to lodge a complaint with dispute resolution body, the Australian Financial Complaints Authority (AFCA).

Last month, Assistant Treasurer Stephen Jones announced a huge change for scam victims when they are seeking compensation for wrongdoing.

ACFA will now be empowered to investigate every bank involved in the scam and for the first time the receiving bank will be on the hook — although the move comes too late for Mr D’Souza.

Consumer Action Law Centre CEO Stephanie Tonkin said the change was a win for future scam victims.

“It stands to reason that the receiving bank is a key link in the criminal chain and up to now AFCA hasn’t been able to investigate its culpability or provide related redress to victims,” she said.

“With these important changes, I am hopeful that future victims will have a better chance to get the compensation they deserve.”

Ms Tonkin said the centre has campaigned for years for to have both the sending and receiving bank investigated by AFCA.

“I look forward to working with AFCA and industry on the details and implementation of these changes, to ensure they really help victims recover the money lost to scams through no fault of their own,” she said.

Meanwhile, Mr D’Souza’s money may also have been stopped if a basic scam measure had been implemented in Australia already.

Account name matching has blocked many fraudulent transactions in other countries and despite a $100 million pledge for Australian banks to roll out the technology — it still isn’t place.

In July 2022, the Australian Competition and Consumer Commission called on the banking sector to establish an industry-wide account name checking system.

Only in late 2023, did the Australian Banking Association announce a $100 million investment by banks to block customers from transferring money if a name does not match the details of the recipient.

But the rollout will not be complete by all Australian banks until the end of this year.

A spokesperson for the Australian Banking Association said implementing an industry-wide confirmation of payee system requires a significant build and investment.

A Westpac spokesperson said stopping scams is one of the bank’s highest priorities and its continuing to invest significantly in scam prevention and detection measures.

“When a customer transfers their money to a scammer, we work hard to recover the money where possible. Unfortunately it’s not always possible,” they added.

“We encourage anyone making large payments or paying an invoice to always use extra caution, including phoning the number of the provider from a public website to confirm payment details.”

sarah.sharples@news.com.au

Originally published as Aussie loses $20k in ‘horrible’ way