ASIC wants to shine a light on big super’s unlisted investments

The corporate regulator wants to dig deeper into ‘private markets’. But will it hinder retail investor options as it seeks to examine big super?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Private markets are booming but the financial regulator is still shuffling around in the dark, with little idea of what’s going on in this opaque corner of the market. That could soon change, with greater regulation looming.

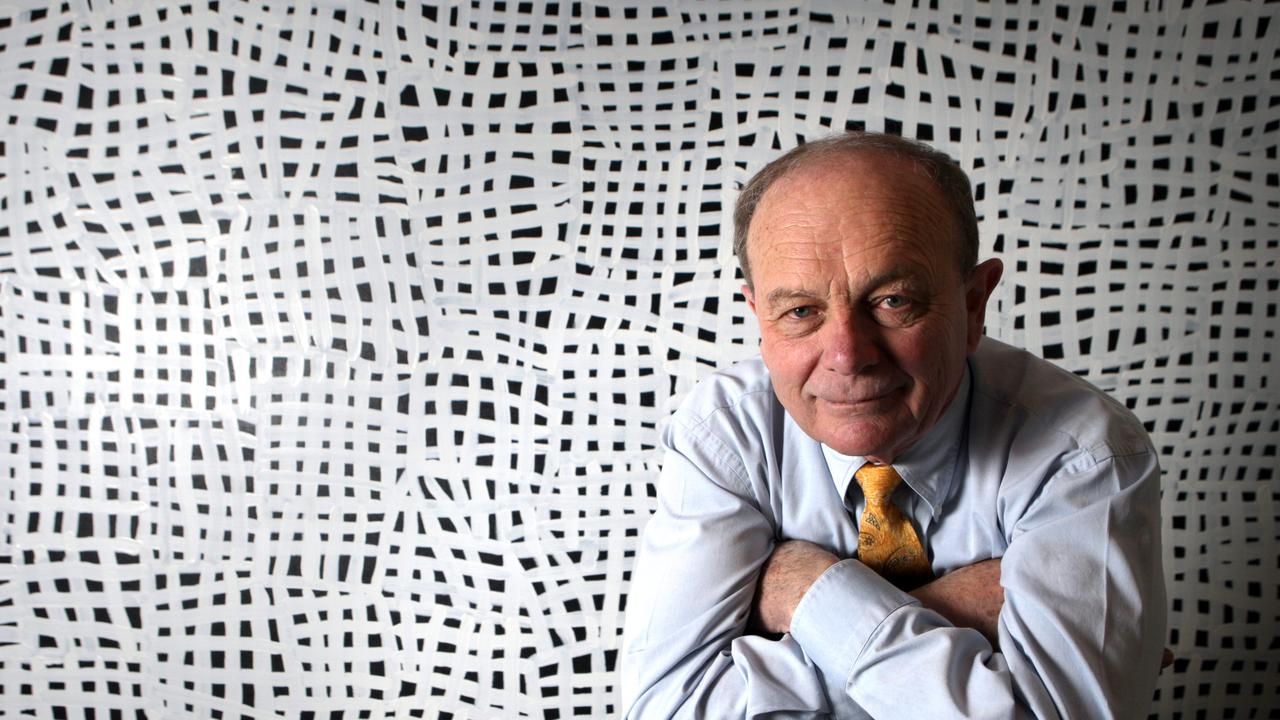

The Australian Securities & Investments Commission this week released what chairman Joe Longo says is the most important piece of proactive work the regulator has undertaken in his time at the helm: a report looking at the changing dynamics between public and private markets.

The critical point for ASIC is whether there needs to be some kind of intervention or a change in regulation to address risks in private markets and unlisted investments, which have grown rapidly.

In Australia it’s a $150bn market, tiny compared to the ASX. Nonetheless, ASIC is worried the next crisis could come from this segment, at a time when Australia’s largest investors, the super megafunds, are pumping people’s retirement savings into these vehicles, which include property, infrastructure, private equity and private credit.

“I can’t do my job in the dark, and we can’t have an intelligent discussion as an economy, certainly as a regulator, without having more transparency,” Longo says. “There are some elements of the private markets that are a little bit defensive about this, that don’t like being questioned. Well, you know what? We’re the regulator, and it’s in the public interest. It’s in everyone’s interest for us to know what’s going on in the private market.”

The nation’s two largest funds – AustralianSuper and Australian Retirement Trust – already have close to a quarter of their assets in private capital and are increasing their exposures. That’s roughly $80bn for AustralianSuper and $70bn for the slightly smaller ART.

It’s not just the big end of town pouring into lucrative unlisted investments. The industry is increasingly courting retail investors, making it easier to get access to private investments, with minimum investments dropping substantially at some funds.

Expect more failures

Private credit, also known as private debt or direct lending, is of particular concern. At $US2 trillion ($3 trillion) globally by some estimates, private credit is now 10 times larger than it was 15 years ago. In Australia, it’s a minnow at just $2.8bn. But ASIC is worried.

“There will be more failures in private credit investments, and Australian investors will lose money,” ASIC commissioner Simone Constant said this week.

For now, the regulator says it is “not its intention” to make it harder for retail investors to access private credit, or other parts of the private market.

“It’s not the role of the regulator to tell investors where to put their money or where to raise finance. It is the role of the regulator to know what is going on in the markets,” Longo says.

But there is no doubt ASIC is laying the groundwork for more regulation. It just wants to get a look under the hood first. It will have to do so as more and more money flows in, including to Sydney-based alternative asset manager iPartners.

The private credit specialist is about to launch a new fund with a warehouse structure – a pool of private loans – to meet the high demand from investors.

“We’ve got an existing warehouse of about $100m, which is effectively full, so we’re launching a new $250m fund,” CEO Travis Miller tells The Australian.

He expects the new fund to be fully deployed within three to six months, such is the demand. Clients are institutional and wholesale investors, but iPartners is branching out into retail: it took a majority stake in Melbourne-based private credit firm Mi Funds Management in December.

It has also had some recent experience of soured loans. Sydney-based debt consolidation firm Salt & Lime collapsed in June owing creditors more than $50m, with more than $42m of that owed to iPartners.

Miller says he and his team are experienced enough to manage these kinds of situations – iPartners has taken over Salt & Lime’s loan book and is running it off – but he also thinks closer regulatory scrutiny of private markets makes sense.

“I think for the sector and the industry, it’s great, it’s a positive. Regulation helps put protections and guardrails up for investors,” Miller says.

Others are not so keen. “ASIC’s focus should remain protecting retail investors in public markets, which are specifically designed to support the direct participation of retail investment. The big private capital money has always found a way to look after itself,” says Allens head of private capital Emin Altiparmak.

The problem, in part, is it’s not just the smart money going after private capital. Retail investors want a piece of the action and Australians are among the most hungry, according to a global report by alternative asset manager Hamilton Lane.

Its latest survey of wealth advisers found 61 per cent of Australian clients were “very interested” in the asset class, compared to 53 per cent of US advised clients.

All up, a third of advisers globally plan to allocate 20 per cent or more of client portfolios to private markets in 2025, with another third planning to put in 10 per cent.

More Coverage

Originally published as ASIC wants to shine a light on big super’s unlisted investments